The “Big Beautiful Bill” (BBB) refers to a proposed federal tax and budget package (also called the One Big Beautiful Bill) recently passed by the U.S. Congress. It builds on the 2017 Tax Cuts and Jobs Act by making many of its tax cuts permanent and adding new provisions. Key provisions include permanent lower tax rates for individuals and businesses, an expanded qualified-business-income (QBI) deduction for small businesses, higher caps on deductions (SALT), and new exemptions (notably exempting all tips and overtime pay from federal income tax). In the Senate and House debates, supporters have framed the BBB as “pro-worker” and “pro-small business,” emphasizing benefits for people who are actively employed. For example, the bill would require able-bodied Medicaid recipients to work 80 hours a month to keep their coverage (underscoring its emphasis on supporting those in the workforce). Other BBB provisions include extending or restoring child tax credits and business investment incentives (100% bonus depreciation, R\&D expensing).

In Kentucky, all but two members of the congressional delegation (Massie and McGarvey) supported the BBB in the House, where it passed narrowly. A Kentucky Chamber analysis notes the BBB would permanently extend the 2017 Tax Act’s lower rates and business deductions. A Tax Foundation study cited by the Chamber predicts these tax cuts could boost U.S. GDP by about 1.2% and create roughly 938,000 full-time jobs. Kentucky-specific estimates (from advocacy groups) suggest that without these extensions, Kentuckians would pay thousands more in taxes and lose thousands of jobs. (For example, Americans for Prosperity warned Kentuckians would face ~\$1,630 higher federal tax per household and ~8,050 lost jobs if 2017 cuts lapsed.) Thus, the BBB is billed as protecting and expanding jobs and take-home pay.

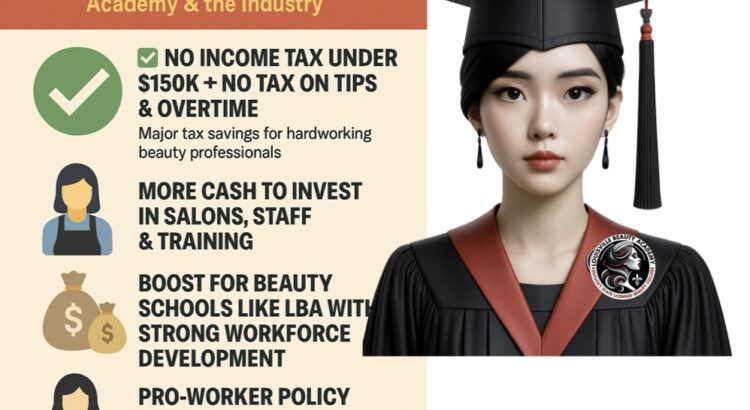

Tax Changes Benefiting Workers and Small Businesses

Several BBB provisions directly support individuals who “actively work” – especially service workers, small-business owners, and self-employed professionals:

- Exemption of Tips and Overtime from Federal Tax: Under the BBB, all income from tips or from overtime pay is exempt from federal income tax. This means a restaurant or salon worker who earns, say, \$5,000 in tips or overtime in a year would keep 100% of that income (no federal tax). In the beauty industry, many cosmetologists and spa workers rely on tips; this change effectively boosts their net pay.

- Small-Business Income Tax Deduction: The BBB makes the Section 199A qualified-business-income (QBI) deduction permanent. In the final legislation, 20% of small-business income is deductible indefinitely (the House version had raised it to 23%). This reduction applies to pass-through entities like S-corporations, LLCs, and sole proprietorships – the legal forms used by most salons, barber shops, and independent beauty professionals. For example, a salon owner earning \$100,000 could deduct \$20,000 of that income, lowering her taxable income. Put simply, salon owners and freelancers pay substantially less federal tax on their business profits under the BBB.

- Higher SALT Deduction Cap: The bill raises the federal cap on deducting state and local taxes. Households (including married couples) earning up to \$500,000 can deduct up to \$40,000 of state/local taxes (up from \$10,000 under current law). This helps Kentucky workers and small-business owners who pay significant local taxes, though the benefit phases out above \$500k. In practice, many middle-income people (including beauty professionals) in Kentucky will be able to deduct more of their property and state taxes on federal returns, lowering their overall tax bills.

- Expanded Child Tax Credit: The child tax credit increases from \$2,000 to \$2,500 per qualifying child (through 2028). Beauty professionals who are parents (for example, hair stylists supporting children) will receive a larger credit. More generous credits mean hundreds of extra dollars per child for working families, freeing more income for household budgets or business investment.

- 100% Expensing of Equipment and R\&D: The BBB permanently restores full expensing (100% bonus depreciation) for investments in short-lived assets. Small businesses, including salons and day spas, can immediately deduct the full cost of new equipment (chairs, mirrors, computers for booking, etc.) or renovation expenses. This accelerates write-offs that were previously stretched out over many years. In practice, a salon could buy new styling stations or professional machines and deduct it all in year one, improving cash flow and encouraging businesses to reinvest in growth.

These provisions collectively lower taxes on earned and business income. According to the Kentucky Chamber, these tax cuts would help families and job creators alike, with far more households seeing net tax decreases than increases. Importantly, service workers benefit directly (via the new tip/overtime exemption) and indirectly (through the overall growth it spurs), while small-business owners gain expanded deductions that free up capital for hiring or expansion.

Table 1: Key BBB Tax Provisions and Effects on the Beauty Sector

| Provision | Beneficiaries / Effect (Beauty Context) | Source |

|---|---|---|

| No federal tax on tips and overtime | Salon and spa employees keep all their tips and overtime wages | [50], [20] (sec. 110101–102) |

| Permanent QBI deduction (20–23%) | Salon owners, barbershop proprietors get lower tax on business profits | [50], [20] |

| Expanded SALT cap (\$40k for ≤\$500k) | Middle-income filers (including high-earning cosmetologists) deduct more state/local taxes | [50] |

| Larger Child Tax Credit (\$2,500/child) | Working parents in beauty industry receive higher tax credit per child | [50] |

| 100% Business Expensing (bonus depreciation) | Salons and beauty product retailers can immediately deduct capital expenses (e.g. equipment) | [50] |

| Medicaid Work Requirements | Encourages able adults (many of whom could join workforce) to work 80 hrs/mo to keep benefits | [20] |

(Sources: Senate House Ways & Means summary; Kentucky Chamber analysis.)

Impacts on the Beauty Industry and Workforce

The beauty sector stands to gain from these tax reforms in several ways. First, the service nature of the beauty industry means many workers earn significant tip and overtime pay; exempting these from tax directly increases their take-home pay. In addition, most beauty businesses are very small: hair salons, nail shops, and spas are overwhelmingly single-location, often owner-operated firms. The enhanced QBI deduction and expensing rules directly lower their effective tax rates, leaving more profit available to hire staff, modernize facilities, or reduce prices. In effect, the BBB lowers the “tax wedge” on everyday work and small-business activity, which advocates argue will spur hiring and entrepreneurship.

Moreover, the beauty industry is large and growing. McKinsey reports the global beauty market is about \$450 billion (as of 2024) and is expected to grow roughly 5% per year through 2030. U.S. spending on personal care continues to rise, and consumer demand for services (hair, nails, skincare, etc.) remains robust. In this context, tax relief can amplify growth: as one industry report notes, American beauty services already employ over 1.3 million people nationwide, and organizations forecast nearly 20% industry growth by 2030. (For example, NAWBO and the Professional Beauty Association support extending tip-credit rules to salons, noting that the sector is predominantly women-owned and tip-dependent.)

Worker empowerment is also an angle. Many beauty professionals are traditionally underserved groups (immigrant women, single parents, formerly incarcerated individuals, etc.) who gain quick, debt-free vocational credentials (see LBA below). By boosting their net pay and easing the tax burden on their employers, the BBB aims to strengthen this entry-level workforce. Additionally, the Medicaid work requirements (80 hours/month rule) reinforce the principle that active work is rewarded – beneficiaries must join the labor force or community service to keep assistance. In sum, the BBB’s tax provisions align with the goal of supporting people “actively working” by reducing taxes on earned and business income in the beauty and service sectors.

Campaigns for Property Tax Relief

While the BBB deals with federal taxes, small business owners (including salons) often cite local taxes as a cost burden. In recent years a nationwide property tax revolt has emerged, with voters in multiple states approving measures to limit or reduce property taxes. For example, Kentucky voters considered (in 2024) a ballot initiative to exempt homeowners over 65 from paying property taxes, and other states like Florida and Colorado have passed caps linking tax growth to inflation. Although these efforts have targeted homeowners, some advocates have begun calling for similar relief for small businesses. In principle, expanding such relief (for example, higher homestead exemptions or credits for owner-occupied business property) would lower operating costs for salon owners as well. While not part of the BBB, these state-level movements reflect a broader push for tax relief. Policymakers sympathetic to small business might eventually propose property-tax relief packages at the state or federal level. For now, the BBB’s emphasis on reducing income taxes complements this trend: even if property taxes remain, owners will have more after-tax income to cover them.

Louisville Beauty Academy (LBA): A Workforce Model

Louisville Beauty Academy (LBA) is a local example of workforce development in the beauty field. LBA is a state-licensed beauty college that has graduated over 1,000 cosmetologists, nail technicians, estheticians, etc. since 2017. These graduates typically begin careers earning roughly \$30,000–\$50,000 per year. Louisville Beauty Academy’s own analysis conservatively estimates its alumni have generated about \$20–\$21 million in Kentucky economic activity (wages and taxes) to date. A Vietnamese-American community news report found the school has “graduated nearly 2,000 professionals, contributing an estimated \$20–\$50 million annually to the Kentucky economy”. This range reflects continued growth – as LBA adds more students each year (over 125 graduates per year on average) the impact rises.

These figures highlight LBA’s economic role: its model (affordable, debt-free, flexible training) rapidly converts students into skilled, licensed workers. The BBB could help scale such outcomes. For example, tax relief on earned income means LBA graduates keep more take-home pay, raising their living standards and enabling them to spend or invest locally. Lower taxes on small businesses mean graduates who open their own salons face less tax drag on profits, encouraging entrepreneurship. If Louisville or Kentucky leaders wanted to expand LBA’s model (e.g. more campuses or similar schools), the freed-up tax revenues from BBB could be partially directed to workforce grants or matching funds. Moreover, a higher SALT cap means local governments could raise modest funds (for education or infrastructure) without triggering federal penalties for higher-earning residents, potentially freeing up state dollars for job training.

Table 2: LBA’s Economic Impact vs. Growth Scenarios (illustrative)

| Approx. Cumulative Graduates | Estimated Annual Economic Impact (KY) | Source |

|---|---|---|

| 1,000 graduates (through 2024) | ~\$20–21 million | Louisville Beauty Academy |

| ~2,000 graduates (projected) | \$20–50 million | Viet Bao Louisville estimates |

| 3,000 graduates (future) | ~\$60–75 million | Projected (extrapolated) |

These numbers suggest that if LBA doubles or triples in size, it could inject tens of millions more into the local economy. Under the BBB, those impacts would be even larger: graduates and salons pay less in federal tax on that additional income. For Louisville’s economy, LBA represents a grassroots engine of job creation, especially for low-income and immigrant communities. Tax policies that preserve graduates’ income and reduce business costs amplify LBA’s success. In other words, BBB-level tax relief can help magnetize further investment in beauty education and small-business formation.

Broader Economic Impact in Kentucky and Louisville

Beyond LBA specifically, the BBB’s tax changes will influence Kentucky’s economy. The Chamber of Commerce notes the BBB will affect taxes and spending statewide. According to analysis cited by Kentucky’s business leaders, federal tax reform in the BBB is expected to raise the state’s GDP modestly and generate jobs. An increase of 1.2% in national GDP could translate to economic growth in Kentucky, given its manufacturing and service sectors. Moreover, by permanently cutting federal tax rates for individuals and businesses, Kentucky families and entrepreneurs will have more disposable income. For beauty-related enterprises, this means customers may spend more on services, and entrepreneurs have more capital to reinvest.

Another consideration is healthcare funding. The BBB’s Medicaid changes (work requirements and altered federal matching for provider taxes) are controversial in Kentucky, a Medicaid expansion state. Kentucky Chamber leaders urged Congress to be cautious about cutting provider funding. While not directly related to beauty, stable healthcare funding for rural hospitals and clinics can affect community health – a factor in overall workforce productivity.

Finally, local public finance: Louisville’s city and county governments will likely see some indirect effects. If federal income tax revenue falls (due to the BBB), states and localities might face pressures to adjust their tax bases. Conversely, the law’s emphasis on small business growth could increase sales and business tax collections at the local level as more businesses expand. At present, there are no direct federal grants for beauty schools in the BBB, but stronger overall economic growth could boost state budgets, potentially benefiting education and workforce programs.

Conclusion

In summary, the Big Beautiful Bill is a sweeping tax-and-spending package that strongly favors working Americans and small businesses. Its key tax breaks – particularly making all tips and overtime earnings tax-free and enhancing deductions for small businesses – directly benefit beauty school graduates, salon owners, and independent cosmetologists. These provisions, combined with expanded credits and investment incentives, encourage the expansion of small enterprises. In parallel, there is growing momentum for property-tax relief measures (through state ballot initiatives) that could further ease costs for business owners.

For Louisville Beauty Academy, which already claims a \$20–\$50 million annual economic impact through its graduates, the BBB provides a more fertile environment to scale up. More graduates will keep more of their earnings, and new salon startups will face lower tax burdens. Overall, analyses suggest the BBB will modestly boost Kentucky’s economy (through job creation and GDP growth). While debates continue over the deficit impact and Medicaid reforms, the BBB as passed effectively locks in lower federal taxes for most workers (especially those earning under ~\$150k) and incentivizes investment. For policymakers and educators in Louisville, this means a historic opportunity: tax savings from the BBB can be channeled into workforce development, with beauty industry training (like LBA) poised to produce the skilled, licensed professionals who will drive the local economy forward.

Sources: Official analyses and reports were used, including Kentucky Chamber of Commerce summaries, Senate press releases on beauty industry tax relief, LBA’s own impact analysis, and news coverage and research on tax and property-reform trends. All figures and quotations are drawn from these sources.

References (APA style with URLs):

- Coffey, S. (2025, May 23). House Passes ‘Big Beautiful Bill,’ Advancing Key Tax and Medicaid Proposals. Kentucky Chamber of Commerce (Bottom Line). Retrieved from https://kychamberbottomline.com/2025/05/23/house-passes-big-beautiful-bill-advancing-key-tax-and-medicaid-proposals/

- Coffey, S. (2025, July 3). “Big Beautiful Bill” Receives Final Passage in Congress. Kentucky Chamber of Commerce (Bottom Line). Retrieved from https://kychamberbottomline.com/2025/07/03/big-beautiful-bill-receives-final-passage-in-congress/

- The White House. (2025). The One, Big, Beautiful Bill – Endorsements. Retrieved from https://www.whitehouse.gov/obbb/endorsements/

- Alsobrooks, A., & Scott, T. (2025, June 18). Alsobrooks, Scott Introduce Bipartisan Legislation to Allow Federal Tax Credit for Beauty Industry Small Businesses. U.S. Senate Press Release. Retrieved from https://www.alsobrooks.senate.gov/newsroom/press/release/alsobrooks-scott-introduce-bipartisan-legislation-to-allow-federal-tax-credit-for-beauty-industry-small-businesses

- Americans for Prosperity. (2025, January 13). AFP Launches \$20 Million Nationwide Campaign Supporting the Trump Tax Cuts to Protect Kentucky Families from Tax Hikes [Press release]. Retrieved from https://americansforprosperity.org/press-release/americans-for-prosperity-launches-20-million-nationwide-campaign-supporting-the-trump-tax-cuts-to-protect-kentucky-families-from-tax-hikes/

- Louisville Beauty Academy. (2024, March 21). Empowering Kentucky’s Economy: A Modest Calculation of Louisville Beauty Academy’s \$20+ Million Economic Impact in 7 Years. Retrieved from https://louisvillebeautyacademy.net/empowering-kentuckys-economy-a-modest-calculation-of-louisville-beauty-academys-20-million-economic-impact-in-7-years/

- Viet Bao Louisville KY – Vietnamese News Community Channel. (2025, May). Why Most Beauty Schools Push Cosmetology — And Why Louisville Beauty Academy Does the Ethical Opposite [Blog post]. Retrieved from https://vietbaolouisville.com/2025/05/why-most-beauty-schools-push-cosmetology-and-why-louisville-beauty-academy-does-the-ethical-opposite-research-2025/

- McKinsey & Company. (2025, June 9). State of Beauty 2025: Solving a shifting growth puzzle. Retrieved from https://www.mckinsey.com/industries/consumer-packaged-goods/our-insights/state-of-beauty

- Hutton, Z. (2024, July 8). Voters in Several States Can Cut — or Abolish — Property Taxes This Fall. Governing. Retrieved from https://www.governing.com/finance/voters-in-several-states-can-cut-or-abolish-property-taxes-this-fall.html