History of Gainful Employment Regulations

The concept of “Gainful Employment” regulations was introduced to ensure that educational programs, particularly those at for-profit institutions, provide value to students by preparing them for gainful employment in recognized occupations. The regulations aimed to protect students and taxpayers by ensuring that federal student aid programs were not funding programs that left graduates with unaffordable debt and poor job prospects.

Key Historical Milestones:

- 2010: The Department of Education under the Obama administration proposed the Gainful Employment regulations to ensure programs receiving federal student aid lead to gainful employment for graduates.

- 2011: Initial regulations were published, establishing metrics to evaluate whether graduates were successfully repaying their student loans and earning enough to manage their debt.

- 2014: Revised Gainful Employment rules were introduced after initial regulations faced legal challenges. These rules focused on debt-to-earnings ratios as the primary measure of program success.

- 2019: The Trump administration rescinded the Gainful Employment regulations, arguing that they unfairly targeted for-profit colleges and created unnecessary burdens for institutions.

Today’s Gainful Employment Regulations

The Gainful Employment regulations have been reinstated and updated under the Biden administration to enhance accountability and transparency in higher education. The regulations are set to take effect on July 1, 2024, with additional requirements coming into force on July 1, 2026.

Key Provisions of the 2024 Regulations:

- Debt-to-Earnings (D/E) Rates: Programs must report the median debt incurred by graduates and their earnings to determine if they meet the requirements for gainful employment.

- Discretionary Income Rate: Annual loan payment divided by discretionary earnings (median earnings minus 1.5 times the poverty guideline).

- Annual Earnings Rate: Annual loan payment divided by median annual earnings.

- Earnings Premium (EP) Measure: Compares graduates’ median earnings to those of high school graduates in the same state or nationally.

- Data Collection: Institutions must report detailed information about program completers, including debt and earnings data.

Additional Requirements Effective July 1, 2026:

- Student Acknowledgements: Prospective students must acknowledge viewing program information on a Department of Education website before enrolling in programs with failing D/E rates.

- Student Warnings: Institutions must provide warnings to current and prospective students if a program is at risk of losing Title IV eligibility due to failing the D/E or EP measures.

- Program Information Website: The Department will host a website with detailed information about programs, including costs, debt, earnings, and accreditation status.

Impact on Educational Institutions

Implementing the Gainful Employment regulations involves significant costs and administrative burdens for educational institutions, particularly for smaller schools. These include:

- Initial Setup Costs:

- Systems and Software: $5,000 – $20,000

- Legal and Audit Fees: $10,000 – $30,000

- Website and IT Infrastructure: $2,000 – $10,000

- Data Security: $5,000 – $15,000

- Student Communication Systems: $1,000 – $5,000

Total Initial GE/FVT Costs: $23,000 – $80,000

- Annual Recurring Costs:

- Staffing: $40,000 – $80,000

- Legal and Audit Fees: $10,000 – $30,000

- Website and IT Maintenance: $1,000 – $5,000

- Data Security Maintenance: $1,000 – $3,000

Total Annual GE/FVT Costs: $52,000 – $118,000

For small institutions like Louisville Beauty Academy, these costs can significantly impact tuition and operational budgets. To illustrate, if the current tuition is $1,000 and the school enrolls 50 students annually, the increased costs could raise tuition to approximately $2,216 – $3,810 per student, representing a 121.6% to 281% increase.

Emphasizing Student Value

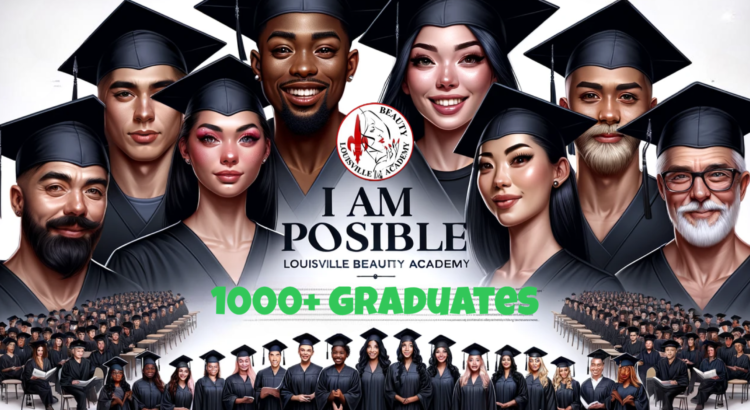

Despite the financial and administrative burdens, Louisville Beauty Academy remains committed to providing high-quality education and ensuring affordability for our students. By not pursuing national accreditation, we have been able to offer substantial tuition discounts, directly benefiting over 1,000 students in the past seven years.

Key Benefits for Students:

- 50-75% Tuition Discounts: Making education more accessible and reducing student debt.

- State Licensing and Accreditation: Ensuring high standards without the additional costs of national accreditation.

Addressing Accreditation Myths

P.S. Accreditation is a myth in terms of the quality of education; it is 100% focused on funding through federal aid and federal loans. It increases barriers and the time committed to formality and paperwork, often distracting school leaders from actually providing education to the students, especially in small schools. It is a myth and confusion among the community that accreditation equates to quality education. The true quality of education is proven and shared as each student attends and recognizes themselves. Competition is healthy, and it results in students determining for themselves which institution works best for them. As human beings, each can judge accordingly and use the options that work best for them.

Conclusion

At Louisville Beauty Academy, our primary focus remains on delivering high-quality education and exceptional value to our students. We appreciate the trust and support of our students and community as we navigate the complexities of regulatory compliance and strive to provide the best possible educational experience. Our commitment to transparency, quality, and student success will always be at the forefront of our mission.

Additional Note: The beauty industry has historically been characterized by self-employment, booth rentals, salon ownership, and commission-based pay structures. Consequently, the vast majority of beauty licensees, including cosmetologists, estheticians, and nail technicians, operate as independent contractors (1099), filing their own taxes and earning a significant portion of their income through tips. This unique payment structure makes it extremely challenging to accurately report salaries and earnings. Moreover, many licensees feel uncomfortable disclosing their salaries to schools or educational institutions due to the nature of their business and income sources, such as tips and other non-traditional earnings. The new Gainful Employment regulations, which emphasize strict reporting of graduates’ income, pose significant difficulties for beauty schools and can be seen as an almost direct attack on the industry. These regulations may inadvertently create additional barriers for beauty professionals and institutions, undermining the industry’s inherent flexibility and entrepreneurial spirit.

REFERENCES

https://fsapartners.ed.gov/knowledge-center/library/dear-colleague-letters/2024-03-29/regulatory-requirements-financial-value-transparency-and-gainful-employment#