Louisville Beauty Academy (LBA) has launched a first-of-its-kind model in U.S. cosmetology education – blending cutting-edge AI tools with hands-on mentorship. LBA harnesses ChatGPT and D-ID video avatars to guide prospective students through enrollment, licensing steps, and exam prep in multiple languages. This AI-driven assistance complements traditional instruction, ensuring each learner receives personalized, 24/7 support. Education experts note that “integrating AI technology into vocational training” (e.g. adaptive learning platforms, virtual reality, AI analytics) is revolutionizing skill development. In the beauty field specifically, thought leaders have demonstrated how ChatGPT can “personalize recruitment, engagement, content creation, [and] customer service” for beauty schools. LBA’s approach – using generative AI to create multilingual video avatars (via D-ID) and real-time Q&A bots (via ChatGPT) – puts it at the forefront of this trend. Notably, D-ID’s avatars can speak over 100 languages and dialects, aligning with LBA’s mission to serve immigrants and non-English speakers. In short, LBA’s “blended learning model” combines in-person practice with “technology-assisted, AI-supported, on-demand” theory education, giving students the best of both worlds.

AI-Human Hybrid Education: A Growing Trend

Education analysts agree that human-AI hybrid models are the future. For example, vocational programs increasingly use AI-powered translation, virtual tutors, and adaptive learning to break language barriers and personalize instruction. LBA’s own materials highlight this: the Academy “embraces AI-powered translation tools and other technologies to make education more accessible”. By contrast, most traditional beauty schools still rely on fixed lecture schedules and textbooks. LBA’s flexible “clock-hour” format lets students set their own hours within a week, while AI-enhanced digital curriculum is available on demand. This ensures that no learner is ever held back by rigid class times – they have “everything they need to succeed from day one to licensure”.

- Blended learning: LBA pairs hands-on labs and live demos with an AI-enhanced digital curriculum and weekly-updated study materials.

- Personalization: Licensed instructors are available all day for one-on-one help, while students can use AI chatbots 24/7 for questions.

- Inclusivity: The program explicitly notes it’s ideal for “immigrants and non-native English speakers” who benefit from custom-paced learning. Generative AI tools (like ChatGPT and D-ID) allow on-demand translation and tutoring, mirroring trends where adaptive platforms create multilingual content to engage diverse learners.

In essence, LBA demonstrates how a vocational school can leverage AI for enrollment and retention, a practice already championed in the industry. By integrating these tools with consistent human mentoring, LBA creates a highly supportive environment. (And unlike online schools that often lead to debt and dropout, LBA’s on-site licensing training assures student success – “there is virtually no reason to fail” when attendance and effort are applied.)

Strong Beauty Industry Growth & Career Outlook

The broader beauty industry is booming, which translates into strong ROI for career-trained professionals. The U.S. Bureau of Labor Statistics projects faster-than-average job growth for beauty careers: barbers, hairstylists, and cosmetologists are expected to grow ~7% from 2023–2033, while skincare specialists/esthetician roles are projected to grow ~10% (vs. 4% for all jobs). These rising demand trends are driven by constant consumer interest in personal care services. In fact, industry data show over 1.4 million people already work in U.S. beauty services, and new licenses are granted every year.

- High employment potential: With tens of thousands of annual openings, new beauty professionals enjoy strong job prospects. Many cosmetology and esthetician graduates find work in salons, spas, or medical offices.

- Entrepreneurship: A significant share of beauty pros become small business owners. Surveys highlight the entrepreneurial nature of the field: for example, a recent study of salon owners found 85% had at least one female owner and 19% were LGBTQ+, reflecting the diverse, community-rooted ownership in beauty. New salon and spa startups have about a 50% survival rate over the first 3 years, demonstrating solid returns for diligent operators.

- Earnings: Median wages can be attractive. (As of 2024, cosmetologists earned roughly $17/hour, and trade careers average ~$68,000/year nationally – often well above local living wages, especially given low tuition costs.)

In short, the beauty sector’s consistent growth and entrepreneurial spirit make it a ripe market. New investors should note that cosmetology programs historically support workforce expansion: LBA itself reports over 1,000 alumni have “successfully entering the workforce or establishing their own small businesses”. This track record underscores the sector’s vitality – and the opportunity for investors to fuel local economies by licensing LBA’s model.

Vocational Training ROI & Debt-Free Education

Compared to 4‑year colleges, vocational cosmetology training offers dramatically lower cost and debt, enhancing ROI. The average full cosmetology program at a private school costs on the order of $15–20K, far below typical college debt. (Indeed, LBA advertises 50–75% tuition savings, aligning with national data that trade programs can be $3K–$30K depending on program length.) Importantly, a recent analysis found most U.S. cosmetology programs fail financial aid “gainful employment” tests – 98% would not meet modest earnings thresholds, and 28% would leave students with unsustainable debt relative to income. This highlights a strong market demand for license-only, debt-free alternatives. Many prospective students now perceive vocational certification as a smart value: a 2022 survey found 75% of Americans think vocational/trade programs are a “good value”, higher than for four-year schools.

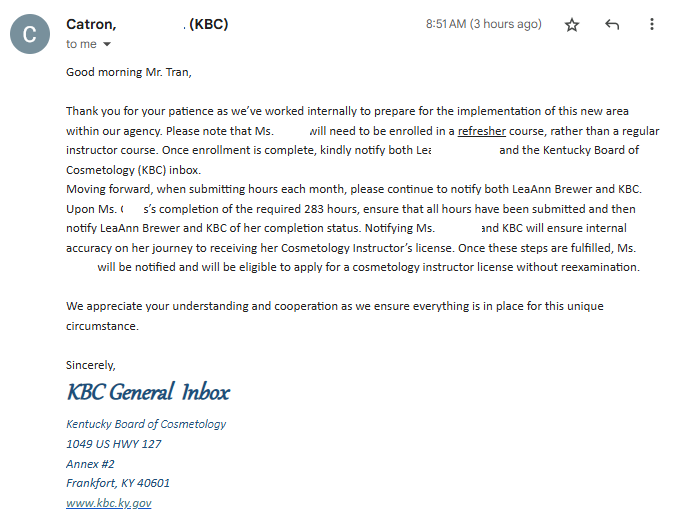

By contrast, traditional for-profit beauty schools have struggled with debt burdens. Reports show 61% of cosmetology students take federal loans (averaging $7,100), often finishing below high-school-level earnings. LBA’s self-sustaining tuition model bypasses this pitfall: students pay out-of-pocket or via income share plans, meaning graduates enter the workforce debt-free. This transparent, cash-based approach is a key part of LBA’s “blueprint for modernizing higher education”. In practice, it creates measurable value: LBA boasts a 95%+ on-time graduation rate and nearly 2,000 graduates since inception, outcomes that traditional schools often cannot match. These results (hundreds of licensure-ready professionals) attract students and keep default rates minimal.

Education as an Investment: Stable Cash Flow & Growth

Savvy investors recognize that education can be a recession-resilient, scalable asset class. As one industry report notes, schools offer “predictable cash flow” (stable tuition revenues) and scalability (replicable models). Compared to many sectors, education remains stable even in downturns – people always need training. By expanding into new communities, an LBA licensee taps into local demand for beauty careers, generating steady tuition income each term. Moreover, owning the school’s real estate (or leasing it at favorable rates) provides an additional layer of return: the property itself can appreciate over time, and the business operations yield dividends from student fees.

Key investment advantages of school franchises include:

- Predictable, multi-layered revenue: Tuition is collected continuously from new and continuing students. LBA also offers skill brush-up courses and retail services, diversifying income streams. As one analysis observes, “schools are no longer limited to tuition fees” – they add services, online platforms, and franchising to grow earnings.

- Real asset value: The school facility is a tangible asset. Just like a commercial property, it provides utility (classrooms/labs) and can appreciate. Investors benefit from this “hard asset” in addition to cash flows.

- Social impact dividends: Beyond money, investors help communities. Beauty schools empower local workers (often from underserved backgrounds) to attain licensure, join the workforce, and start businesses. As GSE Education notes, investors in schools get “high impact” returns – driving jobs and empowerment while earning profits. In LBA’s case, licensees boost economic mobility for residents (especially immigrants and minorities) by offering affordable, career-focused training.

For example, LBA explicitly frames its franchise model as both profitable and purpose-driven. The official offering page invites entrepreneurs to “Build a Legacy. Change Lives. Own a Business with Purpose.”. It emphasizes a 5-year renewable license and “lower cost & higher returns” compared to typical franchises. Crucially, LBA equips licensees with AI-powered tools and support – proprietary student-management software, 24/7 AI chat enrollment assistance, and automated scheduling – to maximize efficiency. These innovations reduce operating overhead and boost retention, enhancing ROI.

Franchise & Licensing Opportunities with LBA

LBA is actively seeking franchise partners and licensees to expand across U.S. counties and cities. Interested investors – from retiring salon owners to venture groups to community entrepreneurs – can apply to operate a fully supported LBA school. Major benefits of the LBA licensing model include:

- Turnkey Business System: Licensees gain a “proven, highly successful model”. The package includes state-approved curricula, accreditation guidance, and marketing assets. (LBA’s materials report that franchise partners receive “SEO-optimized website, social media management” and recruitment strategies.)

- Flexibility & Ownership: LBA offers a five-year licensed partnership (renewable) rather than a rigid franchise chain. Owners keep autonomy over their business, paying no excessive franchise fees. This means higher margins and the freedom to tailor operations locally while still using the LBA brand.

- Advanced Technology: Partners step into a digital infrastructure. LBA provides a custom student management system, integrated online learning (Milady CIMA), AI chatbots for enrollment, and digital compliance tracking. In short, LBA licensees start with “cutting-edge IT and AI tools for operations”, keeping the school ahead of the curve.

- Strong Brand & Social Impact: Operating under LBA’s brand (a state-accredited college) gives instant trust in the marketplace. Meanwhile, owners fulfill a social mission by offering affordable, high-quality education that builds workforce skills and entrepreneurs in their community.

LBA underscores that this is an “opportunity to build, grow, and scale an educational empire”. The numbers back it up: in just eight years LBA has graduated almost 2,000 students (most employed or in business) and maintains a 95%+ graduation rate. This proven track record means licensees join a multi-location, multi-million-dollar enterprise, rather than starting a business from scratch.

Ready to invest or own? Whether you are a baby-boomer entrepreneur, a tech investor, or a local business leader, LBA’s model offers stable returns with social impact. The Academy explicitly calls on investors to “own and operate a licensed beauty academy” under its system. By buying an LBA license, you secure both a real asset and a reliable cash-flow business. Join this pioneering venture – contact LBA to explore franchise/licensing opportunities and help shape the future of beauty education nationwide.

CITATION

Bureau of Labor Statistics. (2024). Occupational Outlook Handbook: Barbers, Hairstylists, and Cosmetologists. U.S. Department of Labor. https://www.bls.gov/ooh/personal-care-and-service/barbers-hairstylists-and-cosmetologists.htm

Bureau of Labor Statistics. (2024). Occupational Outlook Handbook: Skincare Specialists. U.S. Department of Labor. https://www.bls.gov/ooh/personal-care-and-service/skincare-specialists.htm

Century Foundation. (2020). The Beauty School Debt Trap: Large Debts, Low Wages, and the High Risk of Default. https://tcf.org/content/report/beauty-school-debt-trap/

CECU (Career Education Colleges and Universities). (2024). State of the Sector Report: Private Career Education. https://www.career.org

Federal Reserve Board. (2022). Economic Well-Being of U.S. Households in 2022. https://www.federalreserve.gov/publications/2023-economic-well-being-of-us-households-in-2022-student-loans.htm

Georgetown University Center on Education and the Workforce. (2023). The College Payoff: More Education Doesn’t Always Mean More Earnings. https://cew.georgetown.edu/cew-reports/the-college-payoff-2023/

Louisville Beauty Academy. (2025). Official Franchise & Licensing Offering Packet. https://louisvillebeautyacademy.net

Louisville Beauty Academy. (2025). Freedom Factory™ Business Model Overview. Internal publication.

Milady. (2024). CIMA: Cloud-based interactive learning for beauty and wellness education. https://miladytraining.com/cima

National Federation of Independent Business (NFIB). (2023). Small Business Economic Trends Report. https://www.nfib.com/surveys/small-business-economic-trends/

P2P Market Research. (2024). Beauty Industry Market Size and Trends 2024-2029. https://www.p2pmarketresearch.com

Pew Research Center. (2022). Public Trust in Higher Education and Vocational Alternatives. https://www.pewresearch.org

U.S. Department of Education. (2023). Gainful Employment Rule: Final Regulations. Federal Register. https://www.federalregister.gov/documents

World Economic Forum. (2023). The Future of Jobs Report: Vocational & Skills-based Pathways. https://www.weforum.org/reports/the-future-of-jobs-report-2023

Disclaimer: Louisville Beauty Academy is a Kentucky State-Licensed and State-Accredited beauty school. All education and licensing comply with the requirements of the Kentucky State Board of Cosmetology. LBA does not offer federal student aid and operates a cash-based tuition model. Any discussion of business models, franchising, licensing, or investment is for informational purposes only and does not constitute an offer or solicitation. Prospective partners or investors must perform independent due diligence and comply with all applicable laws and regulations. For official inquiries, contact study@LouisvilleBeautyAcademy.net or 502-625-5531.