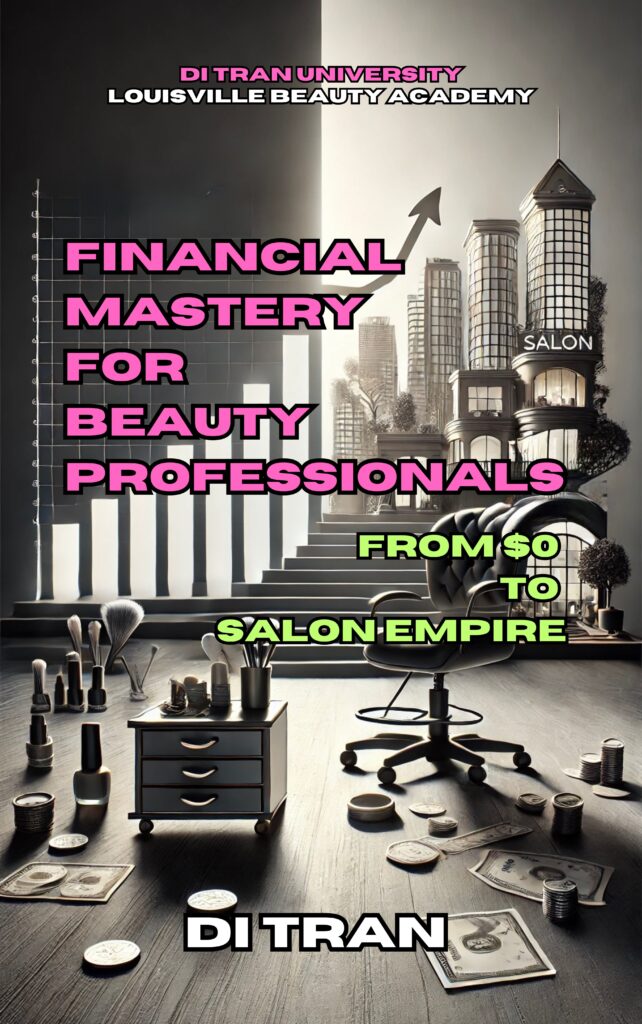

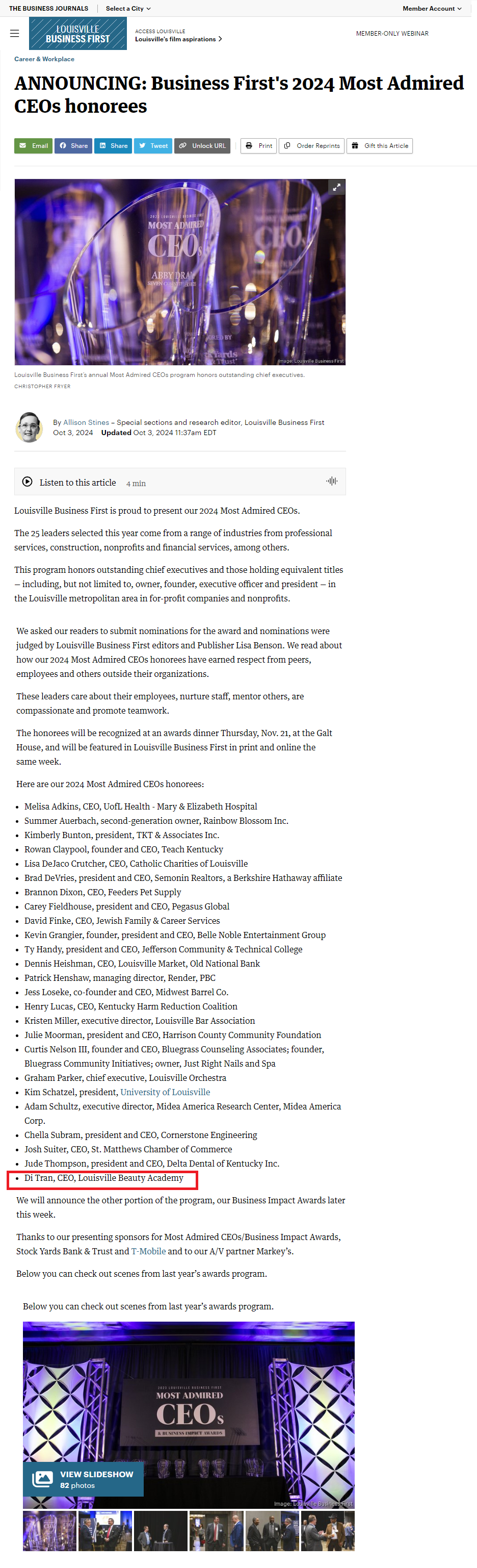

At Louisville Beauty Academy, we don’t just prepare you to be a beauty professional—we prepare you for a successful career and a thriving future. That’s why we are excited to announce the release of Di Tran’s latest book, “Financial Mastery for Beauty Professionals: From $0 to Salon Empire” (2025).

This book is a must-read for every beauty school graduate, licensed professional, and aspiring entrepreneur. It’s not just a guide—it’s a roadmap to transforming your skills into a business and your dreams into a legacy.

What This Book is About

Financial Mastery for Beauty Professionals is designed to help you go beyond the chair. It’s about taking control of your finances, building your own business, and investing in long-term wealth, all while staying true to your passion for beauty.

Written by Di Tran, a licensed nail technician, beauty entrepreneur, and real estate investor with over two decades of experience, the book walks you through every stage of growth—from starting as a beauty school graduate to building a salon empire and securing financial freedom through real estate.

Why Should Every Graduate, Licensee, and Prospect Read This Book?

1. Empower Yourself Financially

This book provides essential knowledge to help you master financial discipline. You’ll learn how to:

- Avoid emotional spending and focus on meaningful investments.

- Budget effectively and save for the future.

- Reinvest in your skills, business, and wealth-building opportunities.

🔑 Why It Matters: Financial knowledge is the key to turning your passion into long-term success. Every dollar you earn and save today is a step toward building the future you want.

2. Build Your Own Business

Whether you dream of becoming a booth renter, salon owner, or multi-location entrepreneur, this book offers actionable steps to get there. You’ll discover:

- How to transition from working for someone else to owning your own salon.

- Strategies to scale your business and create additional revenue streams.

- Ways to lead and empower your team while growing your brand.

🔑 Why It Matters: Owning your own business puts you in control of your career and income. It allows you to create opportunities not only for yourself but also for others in your community.

3. Leverage Real Estate for Wealth

Di Tran shares his insights on using your beauty business to fund real estate investments, turning your income into long-term wealth. You’ll learn how to:

- Identify and purchase properties to house your salon or generate passive income.

- Use real estate as a foundation for financial stability and legacy building.

🔑 Why It Matters: Real estate is one of the most reliable ways to build wealth, and your beauty business can be the engine that drives these investments.

4. Achieve Work-Life Balance

The book emphasizes the importance of maintaining balance as you scale your career. You’ll gain insights into:

- Avoiding burnout while growing your business.

- Prioritizing self-care and relationships.

- Designing a sustainable career that supports both your personal and professional goals.

🔑 Why It Matters: Success is about more than money—it’s about creating a fulfilling life where you thrive in all areas.

5. Leave a Legacy

One of the most inspiring aspects of this book is its focus on leaving a lasting impact. You’ll learn how to:

- Mentor others and empower the next generation of beauty professionals.

- Create a business that thrives long after you’ve moved on.

- Use your success to make a difference in your community.

🔑 Why It Matters: Your career isn’t just about what you achieve—it’s about the opportunities you create for others and the legacy you leave behind.

Why Louisville Beauty Academy Recommends This Book

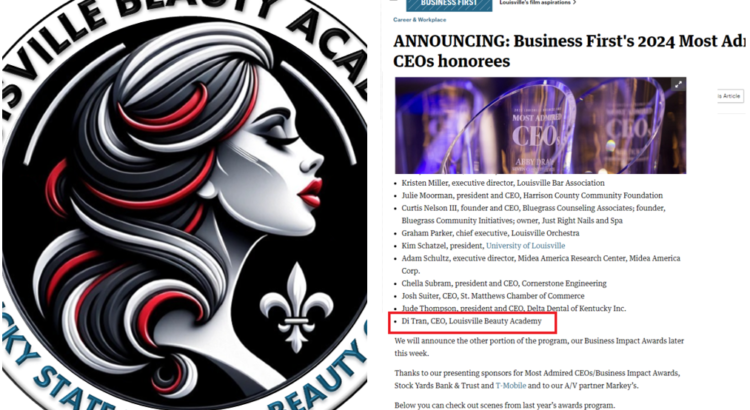

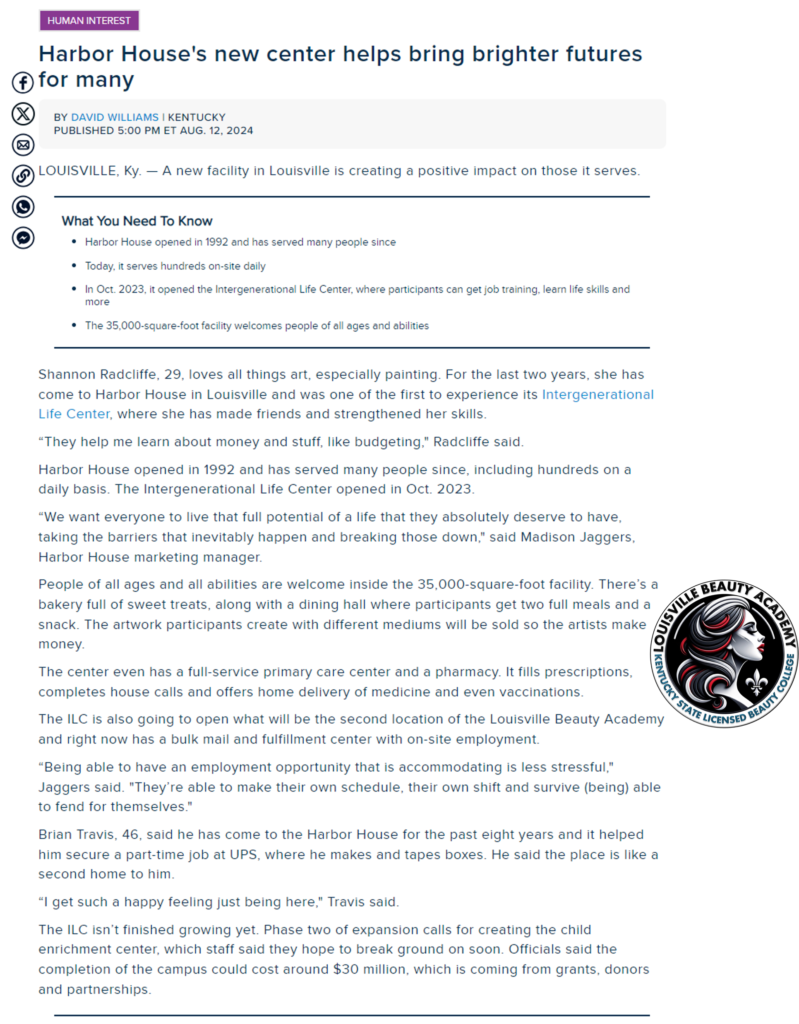

At Louisville Beauty Academy, our mission is to elevate every student to their maximum potential. We provide not only the technical skills needed to succeed in the beauty industry but also the mindset and tools to thrive as entrepreneurs and leaders.

Financial Mastery for Beauty Professionals aligns perfectly with our values of continuous learning, adaptation, and growth. This book is a guide to the very principles we instill in our students:

- The importance of starting small and dreaming big.

- The value of financial discipline and smart investments.

- The potential to build a career that creates both personal success and community impact.

Take Advantage of Your Opportunities

As a student, graduate, or prospective beauty professional, you already have an incredible opportunity to change your life through education. Remember:

- Your investment starts with your education. Every dollar spent on your training is an investment in your future.

- Louisville Beauty Academy offers 50-75% tuition discounts for eligible students. This means you can start your journey with minimal financial burden and focus on achieving your goals.

- Graduate fast, succeed sooner. Our programs are designed to help you complete your education efficiently so you can start earning and building your career right away.

Get Your Copy Today

📚 Grab your copy of Financial Mastery for Beauty Professionals: From $0 to Salon Empire today and take the next step toward your future:

https://www.amazon.com/dp/B0DTNVV5M4

Final Thoughts

This book isn’t just a resource—it’s a roadmap to a better future. Whether you’re just starting out, looking to grow your business, or dreaming of financial independence, Financial Mastery for Beauty Professionals will guide you every step of the way.

At Louisville Beauty Academy, we’re here to support you on this journey. With the right education, mindset, and tools, you can achieve anything.

Dream big. Start small. Build your legacy.