Introduction: Why Classification Matters in Beauty

At Louisville Beauty Academy (LBA), our mission is to empower future beauty professionals through debt-free education without relying on federal student loans. In the beauty industry, many graduates will face a crucial question: Are you an independent contractor or an employee? The answer affects your taxes, your overtime pay rights, and your business decisions. This comprehensive report traces the history and evolution of independent contractor classification rules at the federal level and in Kentucky, highlighting key changes through May 2025. We focus on developments that matter to cosmetologists, estheticians, barbers, nail technicians, and salon owners. Along the way, we’ll explain what these changes mean for labor classification, tax treatment, and compliance – all framed through LBA’s perspective of supporting students and professionals via three anchors of support: family, government, and the school itself.

Independent Contractor vs. Employee: An Overview

In simple terms, an employee works under the direction and control of an employer, while an independent contractor operates their own business. Employees receive wages with taxes withheld, are covered by laws like minimum wage and overtime, and may get benefits like workers’ compensation, unemployment insurance, and employer-sponsored benefits. Independent contractors, on the other hand, have more autonomy – they often set their own schedules, use their own tools, pay their own business expenses, and are paid gross without tax withholding. However, contractors are not protected by many labor laws (no guaranteed minimum wage or overtime pay) and must pay self-employment taxes (covering both employer and employee portions of Social Security/Medicare). Misclassification – treating a true employee as a contractor – can lead to serious compliance problems. For beauty professionals, this distinction is especially important because booth rental arrangements (where a stylist or technician rents space in a salon) are common. Whether a salon worker is a legitimate independent contractor or should be an employee has been a long-running question in our industry.

Federal Rules: A Historical Timeline and Key Changes

The U.S. federal government’s approach to defining independent contractors versus employees has evolved over decades. Understanding this evolution helps beauty professionals grasp why rules are the way they are today. Below is a timeline of major developments at the federal level:

- 1930s – The New Deal and Broad Definitions: The Fair Labor Standards Act (FLSA) of 1938 introduced federal minimum wage and overtime protections for “employees,” but did not explicitly define “independent contractor.” Instead, the law broadly defined “employ” as “to suffer or permit to work,” signaling an expansive view of employment. Early on, courts recognized that some workers were in business for themselves – independent contractors – and thus not covered by FLSA. However, there was no clear statutory test.

- 1947 – The Economic Reality Test: A pivotal year in worker classification. The U.S. Supreme Court decided several cases in 1947 that set the framework for distinguishing employees from contractors. Notably, in United States v. Silk (1947) and Rutherford Food Corp. v. McComb (1947), the Court rejected narrow common-law control tests in favor of an “economic realities” approach. This meant looking at multiple factors – such as the level of control, the worker’s opportunity for profit or loss, their investment in tools, the skill required, the permanence of the relationship, and whether their work is integral to the business – to judge whether the worker is economically dependent on the hiring party (an employee) or truly in business for themselves (an independent contractor). In short, the more economically dependent the worker, the more likely they are an employee. This multi-factor economic reality test became the foundation for FLSA classifications. (Meanwhile, in 1947 Congress also amended other laws like the National Labor Relations Act to explicitly exclude independent contractors, underscoring the distinction.)

- 1960s–1970s – IRS and Tax Classification: The Internal Revenue Service historically used a common-law “right of control” test (with roughly 20 factors) to determine worker status for tax purposes. Employers who misclassify employees as contractors can owe back payroll taxes and penalties. In the 1970s, concerns grew about misclassification to avoid taxes. In response, Congress passed a safe-harbor provision in 1978 (Section 530 of the Revenue Act of 1978), which protects employers from certain tax penalties if they had a reasonable basis for treating a worker as a contractor and consistently did so. This safe harbor still exists, meaning some businesses can legally continue treating workers as contractors for tax purposes even if they might not meet stricter tests – a complexity that shows how tax rules and labor rules can diverge.

- 2010s – Crackdown on Misclassification: With the rise of the gig economy and freelance work, the government renewed focus on worker classification. The Obama administration viewed misclassification as a widespread problem denying workers fair wages and benefits. In 2015, the U.S. Department of Labor (DOL) issued official guidance (Administrator’s Interpretation No. 2015-1) emphasizing that under the FLSA’s broad definitions, “most workers are employees.” This guidance used the economic realities factors to assert that if a worker is economically dependent on a company, they should likely be classified as an employee. The DOL and IRS also formed partnerships with many states (including Kentucky) around this time to share information and enforce misclassification laws. For instance, Kentucky’s Labor Cabinet signed a memorandum of understanding with the DOL to coordinate efforts in 2015, reflecting the growing pressure on employers who might be misclassifying workers to save costs.

- 2018 – Tax Reform and the Gig Economy: An interesting development for independent contractors came with federal tax changes. The Tax Cuts and Jobs Act of 2017 (effective 2018) introduced a 20% tax deduction for qualified business income (IRC §199A). This gave many independent contractors (who report income on Schedule C or via pass-through entities) a potential deduction of up to one-fifth of their earnings, significantly reducing their taxes compared to previous years. This new perk made contractor status more financially appealing to some workers and businesses. At the same time, app-based gig work (Uber, etc.) boomed, sparking debates nationwide about whether gig workers are independent contractors or employees by law.

- 2019 – California’s AB5 Makes Waves: Although a state law, California’s Assembly Bill 5 (AB5) in 2019 had a national ripple effect on the conversation about contractor status. AB5 adopted the strict “ABC test” for most workers, making it much harder to classify workers as independent contractors in California. Under the ABC test, a worker is presumed to be an employee unless (A) they are free from the hiring entity’s control, (B) they perform work outside the usual course of the hiring entity’s business, and (C) they are engaged in an independent trade or business of that type. This test caused concern in industries like beauty, where contracting and booth rental are common. In response, AB5 carved out special exemptions for licensed beauticians: cosmetologists, barbers, and estheticians can still be independent contractors if they set their own rates, schedule their own clients, process their own payments, have their own business licenses, etc. – essentially operating truly independent businesses. While Kentucky and most states did not adopt AB5, the law spotlighted the beauty industry’s unique independent contractor model and foreshadowed how different jurisdictions might handle the issue.

- 2020 – COVID-19 and the CARES Act: The pandemic brought unprecedented changes in unemployment benefits. The CARES Act in 2020 created Pandemic Unemployment Assistance, which temporarily allowed self-employed individuals (independent contractors) to receive unemployment benefits during the crisis. This highlighted the typical exclusion of contractors from unemployment insurance in normal times. It also reinforced the importance of knowing your status – many beauty professionals who were classified as independent had not been paying into state unemployment systems, and thus normally wouldn’t qualify for benefits when salons shut down. The emergency measure was a rare bridge for that gap.

- Late 2020 – Trump Administration’s Rule: In the closing days of 2020, the U.S. Department of Labor under President Trump issued the first-ever federal regulation defining independent contractor status under the FLSA. This rule, scheduled to take effect in March 2021, aimed to simplify and narrow the test. It emphasized five economic reality factors, but elevated two “core factors” above the others: (1) the nature and degree of the worker’s control over the work, and (2) the worker’s opportunity for profit or loss. If these two core factors suggested an independent contractor relationship, the rule made it more likely that the worker could be deemed a contractor. The idea was to provide clarity and arguably make it easier in many cases to classify workers as contractors. For example, a freelance makeup artist who set her own schedule and bore the risk of profit/loss might clearly qualify as an independent contractor under this test.

- 2021 – Rule Rollback and Legal Battles: With a new administration in 2021, federal policy shifted again. The incoming Biden Administration’s DOL immediately delayed the Trump-era rule before it took effect and formally withdrew it in May 2021, signaling a return to the more worker-protective, multi-factor approach. However, industry groups sued, arguing the withdrawal of a duly issued rule was improper. In March 2022, a federal court in Texas ruled that the DOL’s withdrawal was unlawful, effectively reinstating the Trump-era rule. This created some confusion: for a period in 2022–2023, there was a question of which standard applied. The DOL maintained that it would proceed with new rulemaking rather than enforce the Trump rule. The legal tug-of-war underscored how unsettled the classification issue was at the federal level.

- Late 2022 – Biden DOL’s New Proposal: The Biden Administration’s labor officials moved to replace the contractor rule with their own. In October 2022, the DOL proposed a new rule to restore a broader definition of employee under the FLSA. The proposal essentially sought to codify the traditional six-factor economic realities test (similar to what courts have used for decades) into regulations, and to ensure no one factor (like control or opportunity for profit) was given more weight than others. The message was clear: the administration wanted to “reduce the risk that employees are misclassified as independent contractors” and align with longstanding judicial precedent.

- January 2024 – A New Final Rule: After reviewing public comments, the DOL issued a Final Rule in January 2024 (effective March 11, 2024) that officially rescinded the 2021 Trump-era rule. The new rule put in place a comprehensive six-factor test for determining employee vs. contractor status under the FLSA. The factors include: the worker’s opportunity for profit or loss, the investments made by the worker and employer, the permanency of the relationship, the degree of control by the employer, how integral the work is to the employer’s business, and the worker’s skill and initiative. Importantly, no factor is given special weight; it’s a totality-of-circumstances analysis focusing on whether the worker is in business for themselves (true independent contractor) or economically dependent on the employer (employee). This rule essentially returned federal policy to the historical norm, but now with the clarity of being in the Code of Federal Regulations. For beauty industry workers, this means the familiar common-sense questions remain: Does the salon control your work heavily? Do you rely on the salon for most of your income? Do you operate your own separate business? The answers guide your status under the FLSA.

- 2024–2025 – Uncertainty and Shifting Winds: Even after the new rule took effect in March 2024, the story wasn’t over. Business coalitions and some freelance workers filed lawsuits challenging the DOL rule, arguing it could force independent workers into unwanted employment. Those cases are ongoing as of May 2025. Additionally, the political landscape shifted with the 2024 elections. A new administration and Congress in 2025 indicated a different regulatory philosophy. There is potential for the 2024 rule to be revisited or rolled back, depending on policy priorities. The takeaway: federal rules on independent contractor classification have seesawed with administrations, and professionals must stay alert to current standards. As of May 2025, the DOL’s six-factor totality-of-circumstances test is in effect, but continued legal challenges and political debates mean it’s wise to keep an eye on updates.

Kentucky’s Evolution: State Rules and the Beauty Industry

How has Kentucky handled independent contractor classification, especially for salon professionals? State laws come into play for areas like licensing, state taxes, unemployment insurance, and workers’ compensation. Kentucky generally mirrors the federal approach in many respects, but with some unique provisions tailored to the beauty field. Let’s walk through key points in Kentucky’s treatment of independent contractors:

- Traditional Tests in Kentucky: For most of its history, Kentucky relied on case law and common-law principles to distinguish employees from independent contractors. For example, Kentucky courts traditionally looked at factors similar to the federal economic realities test or the common-law control test, depending on the context (whether it was a workers’ compensation case, an unemployment insurance claim, or another dispute). A central question has always been: does the hiring entity have the right to control how the work is done? If yes, the worker is likely an employee; if no and the worker is operating an independent business, they may be a contractor. Other factors considered include the nature of work, skill required, who provides tools/materials, length of the relationship, and whether the worker can profit from sound management of their work. These mirrored the federal multi-factor tests.

- 2004 – Booth Renters Defined as Independent Contractors: A major recognition of the beauty industry’s practices came in 2004, when Kentucky passed a law specifically addressing cosmetologists and nail technicians who lease space in a salon. Under KRS 317A.160 (enacted in 2004), any licensed cosmetologist or nail tech who “leases or rents space” in a salon is deemed an independent contractor for purposes of the state cosmetology laws. In practical terms, this meant if you are a booth renter (renting a chair or booth in a salon) in Kentucky, the state Board of Cosmetology will treat you as an independent contractor business owner, and the salon owner is not held liable for your compliance with cosmetology regulations. This was a significant development because it acknowledged the common business model in our industry and gave salons some clarity and protection – as long as the relationship truly is a lease/booth rental, the state won’t treat the salon as your employer in terms of licensure oversight.

- Separate Booth Rental Licenses (Past Practice): Following the 2004 law, the Kentucky Board of Cosmetology for many years required practitioners to obtain an “independent contractor” license if they were going to operate as booth renters. Essentially, a stylist might have a cosmetologist license and also a separate independent contractor license to be a booth renter. There were fees and annual renewals associated with that. However, this extra licensing step was often seen as redundant and burdensome. In recent years, Kentucky streamlined this process. By 2022, the Board eliminated the requirement for a separate independent contractor license. Now, a cosmetologist or other beauty professional can operate as a booth renter without needing an additional permit from the Board – you simply need your standard practitioner license and a clear rental agreement with a salon. This change reduced red tape and cost for beauty entrepreneurs. (It’s worth noting that salon owners still must ensure the booth renter’s regular license is valid and that they follow state regulations, but the notion of a special “IC license” is gone.)

- Kentucky Wage and Hour Law: Kentucky’s wage laws (Kentucky Wages and Hours Act) generally follow the FLSA standards for minimum wage and overtime. The definitions of “employee” versus independent contractor in Kentucky wage law have been interpreted consistent with the federal economic realities test. In fact, in a case called Mouanda v. Jani-King International (decided by the Kentucky Supreme Court), the court adopted the FLSA’s economic reality analysis for determining employment status under state wage laws. This alignment with federal standards means that in wage disputes (like if a salon worker claims they were an employee owed overtime), Kentucky courts will examine factors such as control, investment, opportunity for profit, skill, etc., just like federal courts do under the FLSA. The key question: Is the worker economically independent (then contractor) or economically dependent on the business (then employee)?

- Kentucky Unemployment Insurance (UI) and “ABC” Elements: For purposes of unemployment insurance taxes and benefits, Kentucky (like many states) has its own statutory test. Kentucky’s UI law leans on a test that includes elements of the “ABC test.” In general, if a business in Kentucky hires someone who doesn’t have their own employees or independently established business, the Office of Unemployment Insurance tends to presume that person is an employee for UI coverage. Two major considerations are (A) the right to control how the work is done and (B) whether the work is outside the usual course of the hiring business. If the worker is performing tasks that are part of the hiring company’s normal operations, and especially if the company could exercise control over the work, the UI division will likely deem that worker an employee, meaning the company should be paying unemployment insurance tax on their wages. For example, if a salon hires a receptionist or a hair stylist, that work is integral to the salon’s business, so those individuals would typically be employees, not contractors, for UI purposes. However, if a salon hires an outside specialist to revamp their website or to do a one-time interior design project, those tasks are outside the salon’s usual business and that worker might be a true contractor. Kentucky uses multiple factors and tests (including a “nature of the work” test and the classic control test) to make these determinations, aiming to prevent employers from avoiding UI taxes through misclassification.

- Workers’ Compensation and Recent Court Clarification: Workers’ comp insurance is another area affected by classification. In Kentucky, employers must provide workers’ compensation coverage for their employees (with some exceptions), but not for independent contractors they hire. Given the independent nature of many beauty practitioners, there have been disputes over who counts as an employee in injury cases. A noteworthy development came in 2023 when the Kentucky Supreme Court addressed the standard for worker status in comp cases (Oufafa v. Taxi, LLC, 2023). Historically, different legal tests caused some confusion, but the state’s highest court decided to unify the approach: it adopted the economic realities test (the same multifactor test used for wage cases and by federal law) to determine if someone is an employee or contractor for workers’ comp purposes. The court essentially said that the fundamental inquiry is the worker’s economic dependence on the purported employer. If a beauty professional is essentially running their own business (bringing their own clients, setting their hours, handling their payments – as a booth renter typically does), they may be considered an independent contractor and would need to secure their own workers’ comp coverage. If they are, in reality, subject to the salon’s control and economically reliant on that salon, they could be deemed an employee entitled to the salon’s workers’ comp protection. This clarification is important for salon owners and independent stylists alike: it reinforces that simply calling someone a “contractor” isn’t enough – the actual working relationship must reflect true independence.

- State Enforcement and Compliance: Kentucky has taken steps to enforce proper classification, though it has generally favored education and guidance. For instance, the Kentucky Education and Labor Cabinet provides guides and checklists for employers to self-audit their worker classifications. They pose questions like: Who sets the worker’s schedule? Who provides the tools and supplies? Can the worker incur a loss or realize a profit? Does the worker offer their services to the general public or just one salon? By answering these, businesses and workers can gauge the correct classification. In cases of flagrant misclassification (for example, a salon treating all workers as “chair renters” but dictating every aspect of their work), the state can impose back taxes (for unemployment insurance), penalties, and require the business to comply with wage laws (including paying any owed overtime or minimum wage shortfalls).

- Licensing Laws and the 2025 Update: Staying licensed is non-negotiable in Kentucky’s beauty field, regardless of employment status. A very recent change as of June 2025 (Senate Bill 22) has tightened the rules: any salon or beauty establishment that allows an unlicensed person to practice can face immediate closure and severe penalties under a new strict liability law. While this is more about licensing than contractor status, it intersects with classification in a way – sometimes salons might be tempted to bring in unlicensed helpers “off the books” (a huge no-no). Kentucky’s new stance is to treat this as an immediate danger to public safety, with salons facing shutdown if caught. The message for schools and professionals is clear: proper licensure and following legal classifications go hand in hand. If you’re a salon owner, whether your worker is an employee or booth renter, they must be licensed or you risk your business. This underscores that government (state board and law enforcement) is a critical anchor of support and oversight, setting the standards that keep the industry safe and fair.

In summary, Kentucky’s approach has been to largely align with federal definitions for determining employee status, but also to explicitly accommodate the beauty industry’s independent contractor practices (through the 2004 law and removing extra licensing hurdles). The state expects salons and schools to maintain high compliance – ensuring everyone is licensed, insured, and properly classified. Kentucky professionals enjoy flexibility, but with that comes the responsibility to follow the rules. LBA plays a role in this ecosystem by educating students on these legal distinctions, so our graduates enter the field prepared to operate within the law whether they choose employment or self-employment.

Recent Developments (2024–2025): Tips, Taxes, and Overtime

The past year or two have brought significant policy moves that directly affect beauty professionals’ wallets and rights. As of May 2025, here are the current updates on labor and tax legislation that impact our industry:

- “No Tax on Tips” – A New Break for Service Workers: In an exciting turn for service industry folks (including hairstylists, nail techs, barbers and anyone who earns gratuities), Congress is on the verge of eliminating federal income tax on tips. The No Tax on Tips Act gained bipartisan momentum in late 2024 and into 2025. In May 2025, the U.S. Senate unanimously passed this act, which would allow workers to exclude up to $25,000 in tips from their taxable income each year (for those earning below a certain high-income threshold). In plainer terms, if you make tips as part of your job, that tip money would no longer be counted when calculating your federal income tax – it would be tax-free income (though importantly, you would still pay Social Security and Medicare payroll taxes on it, since those fund your benefits). The proposal needs approval in the House and the President’s signature, but it has broad support and even a presidential campaign promise backing it, so many expect it to become law. What does this mean for beauty professionals? If you’re a stylist or esthetician receiving tips, you could keep more of what your clients give you. For example, if an employee cosmetologist earns $15,000 in tips in a year, that portion would not incur federal income tax once this law is in effect. It effectively boosts take-home pay without requiring salons to pay more. Salon owners won’t have to withhold federal income tax on tip reporting either (though they still must track and report tips as usual). There is some debate about the broader impacts – critics worry it might encourage employers to shift more pay to tips – but for now, it appears to be a welcomed relief for many working professionals. At LBA, we see this as a government support measure that rewards the hard work of our students and graduates in service roles. Actionable insight: Professionals should continue to properly report tips, but watch for this law’s enactment. It may be wise to consult with a tax advisor once it passes, to adjust your withholding or quarterly tax payments accordingly, and ensure you maximize this benefit.

- Overtime Pay Protections and Changes: Overtime is a key labor protection – generally, employees must be paid 1.5 times their regular rate for hours worked beyond 40 in a week. However, certain employees can be exempt from overtime (for example, managers or professionals paid on salary above a specific threshold). In the beauty industry, many practitioners are paid hourly or on commission and are non-exempt (meaning they should get overtime pay if they work over 40 hours). Salon managers or school administrators, though, might be salaried and treated as exempt. In 2023–2024, there was a significant effort at the federal level to expand overtime pay coverage by raising the salary threshold for exemption. The DOL under the Biden administration finalized a rule to lift the salary cutoff from about $35,500 per year to approximately $58,000 per year in two steps (one step in 2024, then up to $58k on Jan 1, 2025). This would have meant millions more salaried workers nationwide automatically qualified for overtime pay when working long hours, unless their pay was raised above the threshold. For example, a spa manager earning $45,000 salary would have become eligible for overtime under that rule, requiring the employer to track hours and pay extra if they worked over 40 hours in a week. However, in late 2024 this rule was blocked by federal courts after challenges by some business groups and states. Judges ruled that the DOL exceeded its authority by making such a high jump in the salary level, echoing a similar court decision from 2016. By early 2025, with a change of administration, it’s expected that the appeal defending the overtime expansion will be dropped and the rule withdrawn. This means the federal salary threshold likely remains at $35,568/year ($684 per week) for now. In plain terms, as of May 2025, if you are a salaried worker in a salon or beauty school making less than about $35,500 a year, you must be paid overtime for over-40-hour weeks (unless you fall under a very specific exemption). If you make above that and have managerial or administrative duties, you might be exempt. Many beauty professionals are hourly or commission-based and should already receive overtime pay when due – that hasn’t changed. The saga of the overtime rule is still a lesson for our industry: always classify employees properly and pay attention to their hours. It’s also a reminder that labor protections can be strengthened or weakened with shifting policies. For now, any large-scale change to overtime eligibility is on hold. Actionable insight: Salon owners should ensure compliance with current overtime laws – for example, paying time-and-a-half to any non-exempt stylists or receptionists who work long weeks. Schools like LBA must also pay overtime to staff who qualify. Keeping good time records is critical. We also advise staying informed, as future administrations could revisit overtime rules again.

- Other Federal Legislation to Watch: Beyond tips and overtime, there are broader labor law currents that could affect the beauty sector. One is the ongoing discussion around the Protecting the Right to Organize (PRO) Act, a proposed federal law that, among many labor reforms, would adopt an “ABC test” (similar to California’s) to define employees for union-organizing rights. If something like that passed in the future, it could potentially reclassify many contractors as employees under labor law, including booth renters for purposes of collective bargaining rights (though it wouldn’t automatically change their status under wage law or taxes). As of May 2025, the PRO Act has not become law, but beauty professionals should be aware of it in case it resurfaces. Another trend is state-level action: some states are increasing their minimum wages and narrowing exemptions for industries. While Kentucky’s minimum wage remains aligned with the federal level, any salon operating in multiple states needs to comply with each locale’s rules. For example, a chain with a location in a state like California or New York faces very different worker classification and pay regulations than in Kentucky. For our audience mainly in Kentucky, the focus is on our state’s laws and federal baseline rules, but being cognizant of the national landscape is wise for anyone considering mobility or online businesses serving clients across borders.

In summary, the current climate as of spring 2025 brings mostly good news for beauty professionals: likely relief on tip taxes and no new burdens on overtime (since the expansion was halted). Government – at both federal and state levels – is showing support by adjusting policies to help workers keep more income (in the case of tips) and by trying to ensure fair pay for extra hours (in the case of overtime, even though that change is in limbo). These are examples of the “government” anchor of support in action: laws and regulations that can boost or protect the livelihoods of our graduates. LBA stays engaged with these developments so we can educate our students on how to benefit from them and remain compliant.

The Three Anchors of Support: Family, Government, and School

At Louisville Beauty Academy, we believe that success in the beauty profession is propped up by three strong pillars of support:

- Family Support: Family – in whatever form it takes for you (parents, spouse, friends who feel like family) – is often the first source of encouragement and help for an aspiring beauty professional. Many of our students rely on their family’s emotional support, flexible childcare arrangements, or even financial help to get through school without taking on debt. In the context of independent contractor rules and business life, family can play a role too. For example, a family member might help a new graduate with a small loan to buy a starter set of cosmetology tools, or offer a spare room to use as a home salon space (if legally permitted), or simply cheer you on as you navigate the challenges of starting your own clientele. The beauty industry can demand irregular hours, especially when building a business – here family support is crucial for things like adjusting to late evenings or weekend work. Actionable insight: Don’t be afraid to lean on your family network when learning the ropes of the business side – whether it’s asking a sibling with accounting experience for help setting up your bookkeeping, or having a heart-to-heart with your household about your career goals. LBA encourages students to involve their families in understanding industry realities, including the financial and legal aspects, so that those closest to you can help reinforce your professional journey.

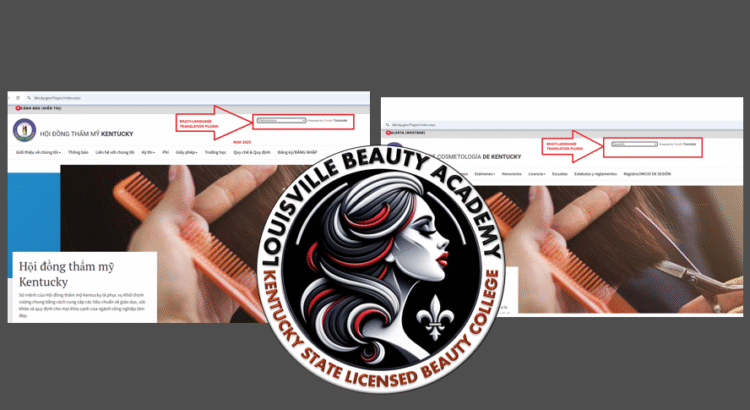

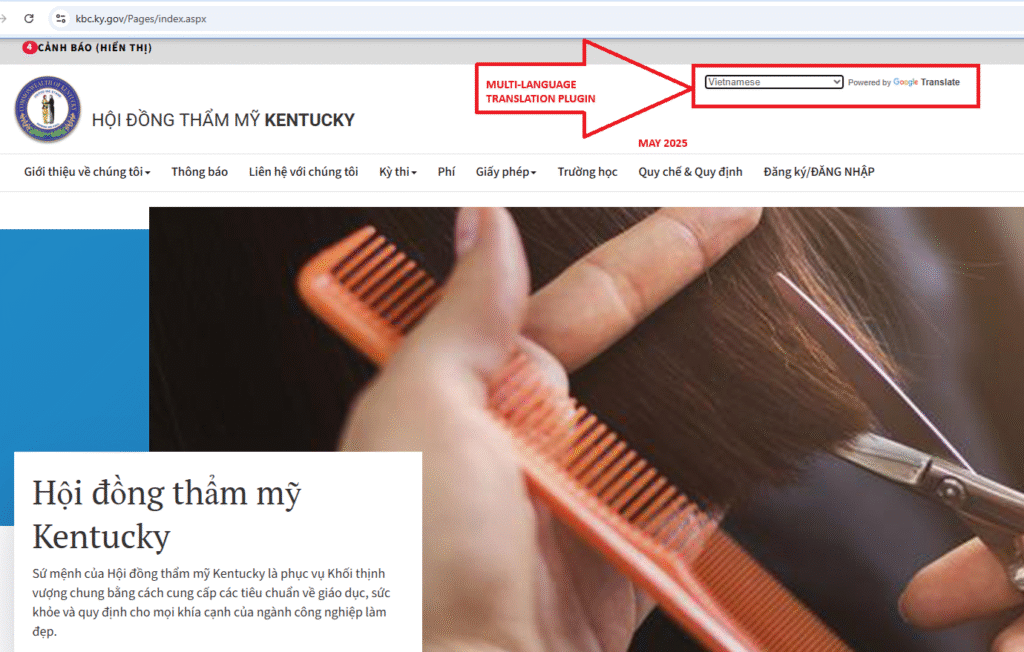

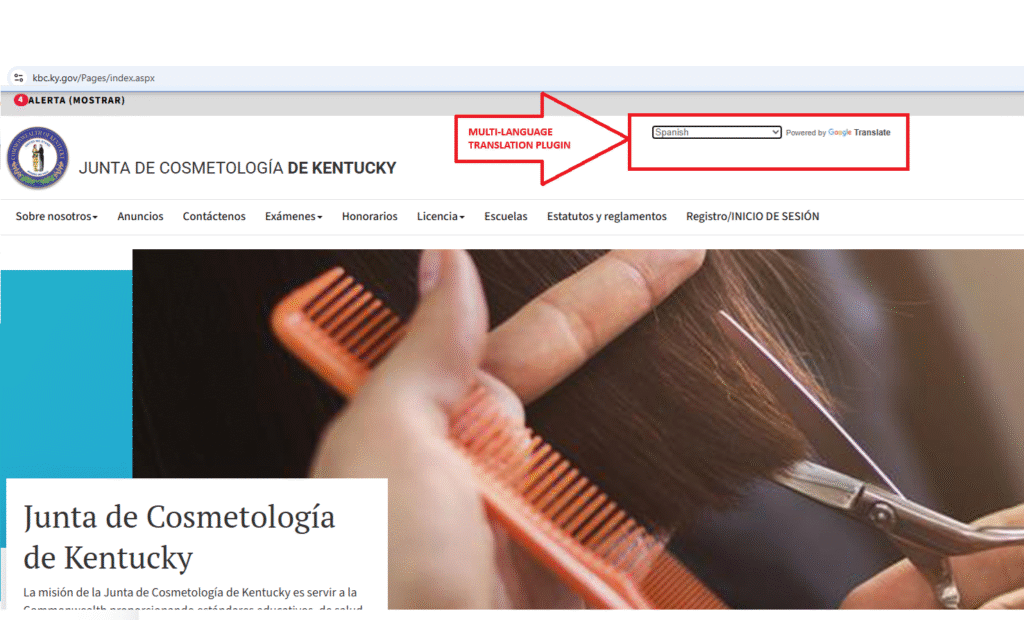

- Government Support (Federal and State): While it may sometimes feel like laws and regulations are obstacles, they are fundamentally meant to support a fair and thriving workforce. Government provides the legal framework that protects beauty professionals and consumers alike. At the federal level, this includes labor laws (like FLSA’s wage and overtime rules), tax laws (like the beneficial tip deduction likely coming, or the self-employment tax structure enabling contractors to contribute toward Social Security), and programs (such as Social Security, Medicare, small business loans, etc., which independent professionals can eventually benefit from). At the state level, government support is seen in licensing standards (which uphold the profession’s integrity and public trust), enforcement of wage laws so ethical salon owners aren’t undercut by those cutting corners, and even state-run programs like workforce development grants or scholarships. For instance, Kentucky has offered scholarships for vocational training in high-demand fields – a savvy beauty student might tap into such opportunities. Moreover, the state unemployment and workers’ comp systems, while sometimes seen as costs for employers, are safety nets for workers if things go wrong – as we saw during COVID when even independent contractors were temporarily supported. Government also supports through information: agencies publish guidelines (e.g., how to properly classify workers, how to start a business) which are free resources for everyone. Actionable insight: Beauty professionals and school owners should view regulators as partners in success. Stay informed about law changes (like the ones we discussed). Use government resources – read the state board’s newsletters, consult the Department of Labor’s small business compliance guides, and don’t hesitate to reach out to agencies with questions. Register your business properly, pay your taxes – these civic duties also open doors to benefits and a level playing field. When you play by the rules, the rules are there to protect you.

- The School (Education and Professional Community): The third anchor is the educational institution and its community – in our case, LBA itself and the network of alumni and industry contacts we cultivate. A school’s role doesn’t end at teaching technical skills; we are equally invested in teaching the business and compliance know-how that underpins a sustainable career. This report is one example: we aim to demystify complex topics like labor classification so our graduates don’t get tripped up by legal pitfalls. In addition, a school serves as an ongoing support hub. Need advice reviewing a salon’s booth rental contract before you sign? We encourage our alumni to reach back out. Not sure how to apply for your first business license or how to file taxes as a self-employed stylist? Our curriculum and mentorship can guide you (for instance, by bringing in guest speakers such as CPA professionals or having modules on career readiness that cover these topics). The school also often acts as a bridge to government – we keep track of changes at the state board, we relay those updates (as we’re doing here with the latest Kentucky regulations), and we instill the importance of abiding by them. Finally, the camaraderie and networking from school can’t be understated. Your peers and instructors form a professional family who can share experiences about different salon setups (employee-based salons vs. booth rental suites), refer opportunities to each other, and collectively raise awareness on rights and best practices. Actionable insight: Current students should take advantage of all the “extra” lessons available about professionalism, law, and finance – they are just as crucial as learning to do a perfect balayage or facial. Graduates should stay connected through alumni groups or social media; often, the answer to a question about “Should I be getting a 1099 or a W-2 from this place?” can be crowd-sourced from trusted colleagues who’ve been there, or you can ask your instructors even after graduation. At LBA, our door remains open. By staying engaged with your school community, you have a lifelong anchor to steady you as the industry evolves.

In essence, these three anchors – Family, Government, and School – work together. For example, a family might encourage a student to enroll and support them through it, the school provides the education and resources, and the government ensures that once the student becomes a professional, there are rules in place to protect their earnings and safety. When all three anchors hold, a beauty professional can truly thrive in a debt-free, empowering career.

Actionable Insights for Schools and Beauty Professionals

Navigating independent contractor rules and labor laws can feel daunting, but knowledge is power. Here are some practical takeaways and tips for different stakeholders in our beauty education field:

For Beauty Schools (like LBA) and Educators:

- Integrate Business Education: Make sure your curriculum includes basic business and legal education. Students should graduate knowing the difference between being a salon employee versus a booth renter, how to read a contract, and how to budget for taxes. For example, we cover how independent contractors must set aside money for self-employment taxes and health insurance, whereas employees might have those handled via withholding and employer plans. By preparing students early, schools set them up for success and legal compliance.

- Stay Current on Regulations: Schools should stay in close contact with state boards and industry associations to get ahead of changes (like new licensing rules or labor laws) and update their teaching materials accordingly. Consider sending periodic newsletters or hosting info sessions for alumni when big changes (like the No Tax on Tips Act) occur. This positions the school as a lifelong learning partner for graduates.

- Model Compliance: Operate your school in exemplary compliance with labor laws. If you employ instructors, abide by wage and hour rules (pay overtime if applicable, etc.). If the school runs a student salon, ensure it follows state trainee regulations and does not inadvertently treat students as unpaid labor. By modeling best practices, schools impart the importance of professionalism. LBA, for instance, as a state-accredited institution, emphasizes proper documentation and pays its staff fairly – showing students that following the law and succeeding in business go hand in hand.

For Salon Owners and Managers:

- Classify and Document Correctly: Decide which model your salon uses (employment or booth rental or a mix) and get it in writing. If you have employees, provide offer letters or employment contracts outlining hours, pay, and duties, and set up payroll with proper withholdings. If you offer booth rentals, use a clear booth rental agreement that spells out the independent contractor nature of the relationship – the renter pays a fee, has control over their services and scheduling, supplies their own products, etc. This document can be crucial if there’s ever a dispute or audit. The checklist from our earlier workers’ comp article is helpful: have written contracts, issue Form 1099-NEC to each contractor earning over $600, do not impose control over their work as if they were employees, and ensure every practitioner (employee or contractor) has a current license.

- Provide (or Require) Insurance: Protect your business and your workers by handling workers’ compensation proactively. Either cover everyone (employees and contractors) under a policy you buy – which eliminates confusion and risk – or, if you have booth renters, require each of them to carry their own liability and (if possible) their own workers’ comp policy, providing you a Certificate of Insurance. This not only is a good business practice, it also reinforces the independent contractor status (a true independent business owner would have their own insurance).

- Embrace Compliance as Competitive Advantage: Instead of viewing labor laws as a burden, see them as a way to stand out. A salon that, say, doesn’t tax tips (when the law allows it) and properly pays overtime will attract talent and build trust with workers. Compliance can save you from costly lawsuits and build a positive reputation. For example, if a salon has been misclassifying workers and gets caught, it could owe back wages and taxes that cripple the business. It’s far better to “do it right” from the start. Many clients also appreciate knowing the businesses they patronize treat workers well – an ethical salon can be a selling point in marketing.

For Beauty Professionals (Students, Stylists, Technicians):

- Know Your Status and Rights: When you start a new job or rental, clarify: will you be an employee or an independent contractor? If you’re handed a Form W-4 to fill out, you’re being hired as an employee (taxes will be withheld, and you’ll likely be under more control – set schedule, house rules, etc.). If you’re asked to sign a booth rental agreement and no taxes are taken from your pay, you’re a self-employed contractor. Understand what each means. Employees: you have rights like minimum wage (so if you’re on commission, the salon must top you up if commissions don’t equal at least minimum wage for hours worked), overtime pay if over 40 hours, employer contributions to your Social Security and Medicare, possibly benefits or unemployment coverage, etc. Contractors: you can set your own hours and often pricing, but you must handle all your own taxes and get no overtime premium – your earnings are purely based on your service prices and tips. If something feels off – for example, if you’re labeled a contractor but the salon dictates your every move and pay structure – that’s a red flag of misclassification. Don’t hesitate to ask questions or seek advice (from mentors, the state board, or even an attorney) if unsure.

- Keep Good Financial Records: If you are an independent contractor, treat yourself like the small business you are. That means keeping track of your income (service fees, product sales, tips) and your expenses (products you buy, chair rental fees, license fees, tools, mileage if you make house calls, etc.). There are many apps and software to simplify this. By tracking, you can not only stay on top of your tax obligations (and benefit from deductions on those expenses), but also evaluate if your venture is profitable. Quarterly estimated tax payments to the IRS and state may be necessary – budgeting for that is crucial so you’re not hit with a surprise tax bill. On the other hand, if you’re an employee, check your pay stubs – ensure overtime is paid when due, and verify that your tips (if on payroll) are correctly reported. It’s ultimately your livelihood; understanding the numbers is part of professional responsibility.

- Continue Education on Business Skills: The learning shouldn’t stop at graduation. The best beauty professionals combine creative skill with business savvy. Take advantage of workshops on topics like social media marketing (to build your clientele), personal finance for entrepreneurs, or advanced technique courses that can allow you to charge higher rates. Being knowledgeable about the latest legislation (like the new tip tax rules) can also give you an edge – for example, if tips become tax-free, perhaps you might initiate a marketing push promoting tipping or adjust how you handle tips versus service charges. Staying informed through industry publications, webinars, or alumni events can keep you ahead of the curve. Remember, your career is a small business in itself – treat it with the same diligence.

For Family Members of Beauty Students/Professionals:

- While not often addressed, families can actively contribute to a beauty professional’s success. Encourage your loved one to talk about what they’re learning in school, and take an interest in the business side of their training. Families can help graduates set up a basic budget, plan for the purchase of equipment, or even serve as practice clients for honing skills. If the beauty professional in your family is opening an independent studio or renting a booth, consider helping them with the initial setup or being a sounding board for their pricing strategy. Also, be patient and understanding during their early career – incomes can be unpredictable at first, and support at home can relieve some pressure as they grow their business. Essentially, families serve as the silent partners in many beauty careers, and recognizing that role can make the journey smoother for everyone.

By focusing on these practical steps and insights, schools and beauty professionals can ensure that the evolution of laws and rules – rather than being scary – becomes something you’re prepared for. Knowledge of the history and current rules is empowering: it lets you adapt your strategies, remain compliant, and even leverage new laws to your benefit (like enjoying that tax break on tips or properly negotiating a booth rental knowing you’ll control your schedule fully). In the beauty world, talent and creativity are vital, but so is being a smart businessperson. Our goal at LBA is to produce graduates who are well-rounded professionals – artists with acumen. We hope this deep dive into independent contractor classifications and related labor laws has demystified the subject and provided actionable guidance for all our readers.

Conclusion: Embracing the Future with Confidence

The landscape of independent contractor rules – federally and in Kentucky – has shifted over time, but one constant remains: the beauty industry thrives on a blend of independence and community. We’ve seen how laws from as far back as the 1940s shape whether a salon worker is treated as an entrepreneur or an employee. We traced how Kentucky acknowledged the independent spirit of cosmetologists with its 2004 booth rental law, and how current efforts (like tax relief on tips and strengthened overtime standards) seek to uplift those working hard in salons and spas.

For Louisville Beauty Academy, this journey isn’t just a history lesson – it is living knowledge that informs how we teach and support our students. Our debt-free model, sans federal funding, is a deliberate choice to keep education accessible and to encourage a mindset of financial responsibility. It also symbolizes a kind of independence that mirrors the entrepreneurial path many of our graduates will take. But “independence” never means going it alone. With family by your side, a fair government framework at your back, and your school as a lifelong coach, you are anchored securely no matter how choppy the waters of policy or economy might get.

As of May 2025, the rules will continue to evolve – they always do. But you now have a detailed map of where we’ve been and where things stand. Use it to navigate your career decisions: choose work arrangements that suit your goals, assert your rights confidently, and fulfill your obligations diligently. Whether you become a salon owner who rents out booths, a stylist building a clientele in a traditional employment setup, or an educator or product rep in the beauty field, understanding these classification rules will help you avoid pitfalls and seize opportunities (such as tax advantages or eligibility for programs).

In the end, being a beauty professional today means being both creative and informed. By grasping the evolution of independent contractor laws, you’re not just keeping yourself out of trouble – you’re optimizing your professional life. You can structure your earnings in the most tax-advantaged way, comply with laws proactively (earning you respect and peace of mind), and maybe even influence the future by participating in industry advocacy (for instance, salon associations often lobby on things like tip taxation and licensing requirements – the voices of professionals matter).

Louisville Beauty Academy will continue to monitor changes and distill what they mean for our LBA family. We’re proud to stand at the intersection of education, industry, and public policy to ensure that our students and alumni – as well as all Kentucky beauty professionals – have the clarity and confidence to flourish in their careers. The beauty business should be empowering, and that extends beyond the salon chair to the legal and financial foundation beneath it.

Empowered with knowledge, supported by family, guided by sensible government policies, and backed by your school – you are prepared to succeed as a beauty professional in Kentucky and beyond. Keep this guide handy, stay curious, and remember that learning is a lifelong process. As you shape the world around you with your creativity, don’t hesitate to also shape it by demanding fairness, embracing changes, and lending support to the next generation that will follow in your footsteps. Here’s to a bright and secure future for all our stylists, barbers, makeup artists, nail techs, and beauty entrepreneurs – you make the world more beautiful, and you deserve a system that lets you shine.

References

- Glum, J. (2025, May 21). No tax on tips 2025: When will it start? Money. Retrieved from https://money.com/no-tax-on-tips-eligibility-start-date/

- Maynard Nexsen. (2024, February 21). DOL issues final rule on classification of independent contractors. Retrieved from https://www.maynardnexsen.com/publication-dol-issues-final-rule-on-classification-of-independent-contractors

- U.S. Department of Labor. (2024, April 23). Biden-Harris administration finalizes rule to increase compensation thresholds for overtime eligibility, expanding protections for millions of workers [Press release]. Retrieved from https://www.dol.gov/newsroom/releases/whd/whd20240423-0

- Reuters. (2024, December 30). Another judge blocks Biden rule expanding overtime pay. Retrieved from https://www.reuters.com/legal/litigation/another-judge-blocks-biden-rule-expanding-overtime-pay-2024-12-30/

- Kentucky Revised Statutes § 317A.160 (2004). Cosmetologist and nail technician lessees as independent contractors – Limitation of salon operator’s liability. (Enacted by Ky. Acts 2004, ch. 9, § 2). Retrieved from Justia website: https://law.justia.com/codes/kentucky/2017/chapter-317a/section-.160/

- Lockaby PLLC. (2023, November). Is it time to face economic reality? Kentucky Supreme Court adopts economic realities test for classifying employees in workers’ compensation cases [Blog post]. Retrieved from https://lockabylaw.com/blog/2023/11/is-it-time-to-face-economic-reality-kentucky-supreme-court-adopts-economic-realities-test-for-classifying-employees-in-workers-compensation-cases/

- Louisville Beauty Academy. (2023, April 17). Important update from the Kentucky Board of Cosmetology – April 17, 2025 [Blog post]. Retrieved from https://louisvillebeautyacademy.net/important-update-from-the-kentucky-board-of-cosmetology-april-17-2025/

- Louisville Beauty Academy. (n.d.). Workers’ compensation in the beauty industry: What every Kentucky salon and school needs to know [Blog post]. Retrieved May 22, 2025, from https://louisvillebeautyacademy.net/workers-compensation-in-the-beauty-industry-what-every-kentucky-salon-and-school-needs-to-know/

- Nolo. (n.d.). Exempt job categories under California’s AB5 law [Legal encyclopedia article]. Retrieved May 22, 2025, from https://www.nolo.com/legal-encyclopedia/exempt-job-categories-under-californias-new-ab5-law.html

- Kentucky Education & Labor Cabinet. (n.d.). Employee or independent contractor guide. Retrieved May 20, 2025, from https://elc.ky.gov/Workers-Compensation/Pages/Employee-Independent-Contractor-Guide.aspx

Disclaimer:

Louisville Beauty Academy (LBA) provides the information shared here exactly as it is at the time of publication. Labor laws, tax regulations, and independent contractor classification rules frequently change, so while we aim for accuracy and thoroughness, this content reflects research and developments only up to the date it is posted. As laws and policies evolve, please verify current regulations through official state and federal sources. This material serves primarily as historical context and educational guidance for industry professionals and students.