The Gainful Employment Rule, introduced by the U.S. Department of Education, has brought significant changes to the requirements for beauty schools, particularly those offering cosmetology, massage therapy, and other wellness-related certifications. This law, designed to protect students from accruing unmanageable debt, requires schools to prove that their graduates can find jobs and earn enough to repay their student loans. However, the added administrative burdens and expenses have placed immense strain on these institutions, resulting in a wave of closures.

Here’s a comparison of the requirements before the law and the new requirements after its implementation, highlighting the hardships many schools now face.

Requirements Before the Gainful Employment Rule:

- Basic Accreditation and Licensing:

- Schools needed to be accredited by a recognized accrediting body and meet state licensing requirements. This included compliance with curriculum standards, instructional quality, and ensuring students passed state board exams to obtain their licenses.

- Compliance with Federal Student Aid:

- Schools offering federal financial aid (such as Pell Grants or federal loans) had to ensure proper administration of funds, track student enrollment, and submit basic financial data to the U.S. Department of Education.

- Job Placement Rates:

- While some accreditation agencies required schools to report job placement rates, the process was less rigorous. Schools typically used surveys or informal tracking to demonstrate that graduates were employed in their field.

New Requirements Under the Gainful Employment Rule:

- Debt-to-Earnings Accountability:

- Schools must now prove that their graduates earn enough income to manage their student loan payments. Specifically, the graduates’ annual loan payments should not exceed 8% of their total income or 20% of their discretionary income(Modern Salon). Schools are responsible for tracking and verifying this data, adding substantial administrative and financial burdens.

- Documenting Graduate Earnings:

- Unlike before, schools must now provide verifiable data on graduate earnings. This includes requiring graduates to submit pay stubs, tax forms (such as W-2s or 1099s), or using third-party employment verification services. Many graduates, particularly those in the beauty industry who rely on cash payments and tips, are reluctant to provide such documentation, making compliance almost impossible for schools(Salary.com)(Cosmetology Career Now).

- Loss of Federal Funding:

- Schools that cannot demonstrate that their graduates meet the required earnings thresholds lose access to federal financial aid, which is often critical for attracting students. For many beauty schools, this is a death sentence, as the majority of their students rely on federal loans and grants(MyAACS).

- Increased Administrative Costs:

- The cost of complying with the Gainful Employment Rule has increased dramatically. Schools must hire additional staff to manage data collection, process graduate employment information, and ensure compliance with federal regulations. Smaller schools, in particular, struggle to meet these added expenses(MyAACS).

- Higher Risk of Closure:

- Schools that fail to meet these stringent requirements face immediate consequences, including loss of accreditation and eventual closure. The inability to prove graduates’ income often stems from factors beyond the school’s control, such as the large number of independent contractors in the beauty industry who underreport income(Cosmetology Career Now)(BLS.gov).

Increased Financial and Operational Burden:

- Before: Schools had to manage student enrollments, provide quality education, and ensure graduates passed licensing exams.

- After: In addition to these duties, schools must now track and prove post-graduation earnings, often from graduates who are reluctant to share income data or work as freelancers in cash-based economies. This creates a nearly unmanageable burden for schools that already operate with tight budgets.

Impact on Beauty Schools:

The Gainful Employment Rule has disproportionately impacted beauty and wellness schools, where many graduates work as independent contractors, often without consistent or traceable income. Schools now find it nearly impossible to provide the federal government with the necessary documentation to prove that their graduates are earning enough to meet loan repayment requirements.

As a result, beauty schools across the nation are shutting down due to the immense financial and regulatory pressures. In fact, many accredited institutions that once thrived by offering affordable career training to thousands of students are now unable to operate in this new regulatory environment(MyAACS)(Salary.com).

EXAMPLE OF COSMETOLOGY PROGRAM WITH AVERAGE COST OF $20,000

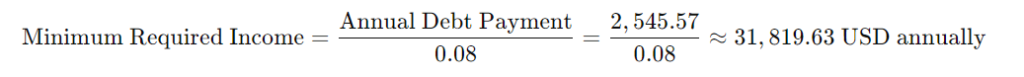

For a $20,000 cosmetology program with a 5% annual interest rate and a 10-year repayment term, the following calculations apply:

- Monthly Loan Payment: Approximately $212.13

- Annual Debt Payment: Around $2,545.57

Compliance with the Gainful Employment Rule:

According to the Gainful Employment Rule, the annual debt payment must not exceed 8% of a graduate’s total income. This means that for a graduate to afford the loan payments, they would need to earn at least:

In this scenario, 8% of the graduate’s total income would go toward loan payments, while the remaining 92% would be available for other living expenses such as housing, food, transportation, and savings. This ensures that the student can manage their loan obligations without being financially overburdened, leaving the majority of their income for essential needs and discretionary spending.

The school must also provide transparent data on job placement rates, average earnings, and loan repayment expectations to ensure students are fully informed about their financial obligations and potential post-graduation income.

Collecting Data Challenges – VERIFIABLE PROOF OF GRADUATES EARNINGS

Under the Gainful Employment Rule, schools must provide verifiable proof of their graduates’ earnings to demonstrate compliance with the required debt-to-income ratio. The acceptable forms of proof include:

1. Official Employment Records:

Schools can use data from third-party employment verification services that track graduate employment outcomes. This data typically comes from state or federal agencies that collect information on wages and employment status.

2. Graduate-Provided Pay Stubs:

Graduates can submit their own pay stubs as proof of income. These stubs should show consistent earnings over a period, typically spanning several months, to give a reliable picture of income.

3. W-2 Forms or Tax Returns:

For independent contractors or those with fluctuating income, schools can request W-2 forms or tax returns as official documentation of annual income. For 1099 workers, 1099 tax forms would also serve as proof of income.

4. State Employment Data:

In some cases, schools can obtain state employment data through agreements with state labor departments. This data reflects the earnings reported to the state for tax purposes, which can be used to validate income for a large group of graduates.

5. Graduate Surveys:

Schools often rely on graduate surveys where students self-report their employment status and income. While surveys alone may not suffice for regulatory compliance, they can be combined with other documentation to meet requirements.

6. Employer Verification:

Employers can confirm a graduate’s income by providing documentation directly to the school. This could be in the form of an official letter from the employer or other records that verify employment and salary(

Challenges:

- Privacy Concerns: Graduates may be uncomfortable sharing their detailed earnings information.

- Independent Contractor Income: Many cosmetologists work as independent contractors (1099 workers), making their income harder to track through traditional means like pay stubs or W-2s, especially if cash payments are involved(Cosmetology Career Now).

In summary, schools are required to provide credible, verifiable documentation, which can come from a variety of sources such as pay stubs, tax forms, or employment data. The goal is to ensure that graduates are earning enough to repay their student loans without being financially overburdened.

Conclusion: Navigating the New World of Beauty Schools and FAFSA Challenges

The landscape of beauty education has shifted dramatically with the implementation of the Gainful Employment Rule. As federal financial aid, including FAFSA, becomes increasingly difficult for beauty and trade schools to access, both students and schools face new challenges. The regulation’s strict requirements for debt-to-income ratios mean that many beauty schools are at risk of losing eligibility for financial aid. For students relying on FAFSA, this could lead to increased tuition costs as fewer schools qualify for federal aid(Modern Salon)(MyAACS).

However, Louisville Beauty Academy stands out as an exception in this evolving market. With a model that emphasizes affordability and flexibility, the school has consistently achieved a graduation success rate of over 90% and similar employment rates. What makes Louisville Beauty Academy particularly appealing is its scholarship offerings, which provide 50-75% tuition coverage based on attendance and other incentives. This empowers students to graduate debt-free or with significantly lower costs compared to other institutions(BLS.gov).

Louisville Beauty Academy’s model ensures that students are not burdened by high tuition fees and, even if loans are involved, they amount to 70-90% less than at other schools. This combination of affordability, a supportive environment, and a focus on student success makes it an ideal choice for prospective students.

For investors, Louisville Beauty Academy is a prime opportunity. The school’s success-oriented, cost-effective model is ripe for expansion. Its humanizing approach, as championed by Di Tran University, focuses on elevating students in a family-oriented environment, ensuring that both students and investors benefit from the institution’s growth.

As both students and investors navigate this new world, it’s crucial to ask the right questions about a school’s financial aid eligibility and affordability, making Louisville Beauty Academy a top contender for the future of beauty education.