The U.S. beauty industry is a massive economic driver – contributing an estimated $308.7 billion to GDP and supporting 4.6 million jobs in 2022. Yet the traditional model of cosmetology education often saddles students with excessive debt, low wages, and regulatory burdens. In contrast, Louisville Beauty Academy (LBA) has emerged as a national pioneer: a cash-based, debt-free, state-licensed beauty school offering hands-on programs in nail technology, esthetics (skin care), shampoo styling, eyelash extension, and full cosmetology. By eschewing federal aid (FAFSA/Pell loans) and focusing on state licensing requirements, LBA cuts costs dramatically. For example, LBA’s nail tech program (450 hrs) costs only $3,800 (discounted from $8,325), its esthetics program (750 hrs) $6,100 (from $14,174), and even the 1500-hour cosmetology program just $6,250 (vs. $27,025 at typical schools). These prices are 50–75% below conventional beauty colleges, allowing students to pay-as-you-go and graduate debt-free. LBA emphasizes licensure-focused, short-term programs that meet Kentucky state board requirements (450–1,500 hours) and graduate on time, rather than padded curricula designed to extract federal aid. Its stated mission is “beauty services as a right,” providing 100% free services (haircuts, nails, facials, etc.) to vulnerable groups – disabled clients, seniors, the homeless, foster children and more – thereby embedding community service into the curriculum.

Debt-Free, Cash-Based, State-Licensed Model

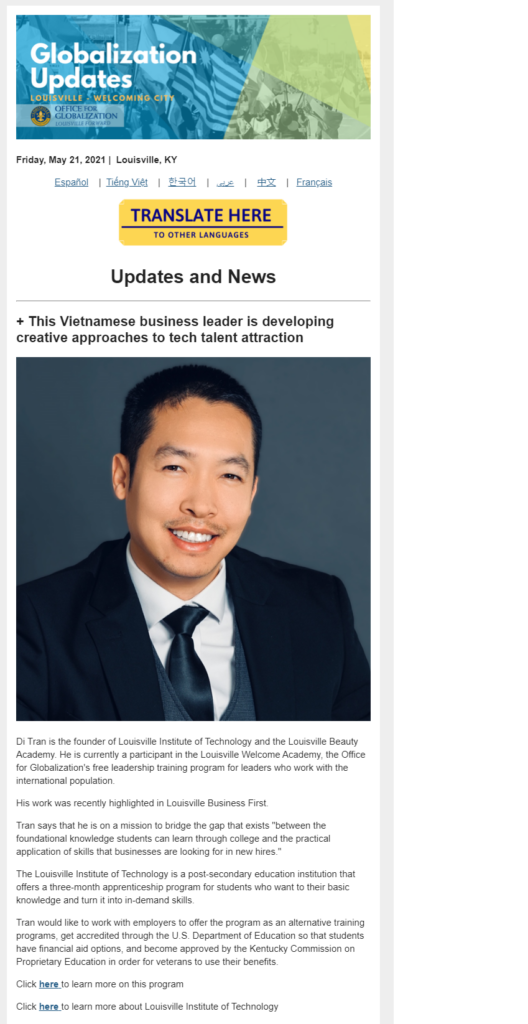

LBA operates entirely on a cash-based, no-loans model, a design that frees both students and the school from burdensome federal regulations. As a Kentucky state-licensed, state-accredited institution, LBA delivers short, skills-focused programs (e.g. 450–750–1500 training hours) aimed squarely at passing licensing exams, not at accumulating excess credits. This allows LBA to recruit in-house, family, and employer support instead of relying on Pell Grants or Stafford loans. By eliminating FAFSA and federal aid, LBA avoids costly accreditation overhead and compliance delays. As one LBA analysis explains, “students can pay as they go or make manageable out-of-pocket payments, allowing them to avoid federal loans entirely”. The result: tuition under $7,000 for a full program (including kits/books), versus $15,000–$18,000 at other schools. In effect, LBA is a “Freedom Factory” – empowering students with career skills without the shackles of debt. The school boasts “50%-75% lower tuition than federally funded schools,” weekly graduations, and a flexible, student-driven schedule. As founder Di Tran notes, LBA’s graduates enter the workforce immediately debt-free, able to build careers or start salons rather than being tied down by loan repayments.

Removing Barriers and Costs by Avoiding Federal Aid

Traditional beauty colleges often pad hours and labs to qualify for more federal aid, inflating costs and time-to-graduation. In contrast, LBA’s model “cuts all unnecessary delays,” enabling students to graduate faster and start working sooner. Without the need for Department of Education approval, LBA sidesteps costly accreditation requirements and reports an unprecedented 95%+ on-time graduation rate. This lean approach translates into savings over $10,000 per student compared to typical schools. For example, where a peer cosmetology program costs ~$17,000 (tuition plus supplies), LBA’s all-inclusive programs top out at ~$7,000. Students therefore “can graduate ready to invest in their careers rather than repay student loans”. In effect, LBA lowers barriers to entry – eliminating credit hurdles and loan applications – and passes cost savings directly to students. Key advantages include immediate enrollment (no waiting for aid approval), interest-free payment plans, and even scholarships that further discount tuition for low-income students. The success of this model is evident in LBA’s own advertising: “Louisville Beauty Academy’s pricing model saves students over $10,000… giving them a unique advantage”.

National Statistics: Debt, Default Rates, and School Closures

The broader data on cosmetology education underscores LBA’s necessity. Beauty school programs are expensive and leave many with heavy debt and poor outcomes. A 2021 Institute for Justice report found that aspiring cosmetologists “borrowed over $7,300 on average” to complete programs that often cost over $16,000. In fact, three years after graduation, the average cosmetologist’s earnings are only about $16,600, making loan repayment difficult. Nationwide, nearly 200,000 students enrolled in cosmetology programs in 2018–19, with over 1,000 schools accepting federal aid and receiving more than $1 billion in federal loans/grants in 2019–20. Yet these investments have not paid off for many: fewer than one-third of students graduate on time, and even longer-term completion rates rarely exceed two-thirds.

High debt translates into high default rates in this sector. In one analysis, barber and cosmetology schools dominated the worst default statistics: among the ten schools with the highest 2016 federal default rates, eight were barber schools and the ninth was a cosmetology school. Similarly, several vocational institutions have faced federal sanctions for aid mismanagement. For example, the Marinello Schools of Beauty (56 campuses) abruptly shut down in 2016 after the U.S. Department of Education found “improperly allocating federal student aid money” (e.g. fraudulent high-school diplomas). Marinello had received over $87 million in Pell grants and loans in 2014–15, yet collapsed amid allegations of fraud. The operators ultimately paid an $8.6 million settlement to resolve claims that they “manipulated the system in order to fraudulently secure student aid funds without which the school could not function”. Such scandals highlight how reliance on federal aid can incentivize profit over education, leading to school closures and student harm. By contrast, LBA’s no-loan model avoids these pitfalls and insulates its operations from federal enforcement actions.

Community Service and Social Impact

LBA actively channels its mission into social care, serving underserved populations free of charge. It partners with nonprofits and housing initiatives (e.g. NABA’s Love Housing) to offer 100% free manicures, haircuts, facials, nail care, and more to seniors, people with disabilities, children in foster care, the homeless, and even caregivers. These services have measurable well-being benefits. Studies show that grooming and salon treatments boost mood, self-esteem, and social engagement among older and vulnerable adults. In LBA’s own pilot (“Beauty for Connection”), students brought personal care and companionship into nursing homes and shelters, visibly lifting spirits and combating loneliness. Facility staff reported “improved mood and engagement” on spa days, and seniors expressed renewed dignity from being pampered. Over time, such programs can even reduce healthcare costs: LBA conservatively estimates $2–3 million per year saved by preventing falls, infections or depressive episodes through regular grooming services.

For the students, community service is likewise transformative. Working alongside instructors, students gain real-world experience cutting hair for clients with mobility challenges or sensitive health needs. Many student volunteers (many are immigrants themselves) report a deep sense of purpose, empathy and confidence from helping others. LBA explicitly tracks impact: to date its volunteers have logged 30,000+ service hours in eldercare and social service facilities, equating to over $500,000 in donated service value at market rates. Hundreds of seniors and vulnerable individuals have been served so far. This “loveflow” of giving not only improves community well-being, it enriches students’ lives and reinforces the academy’s ethos that “beauty is not a luxury, it’s a fundamental human need”. In short, LBA functions as a “Freedom Factory” — generating financial freedom for students, social freedom (connection and dignity) for clients, and a culture of care and service (spiritflow) throughout the community.

Traditional Beauty Colleges vs. LBA’s Model

By contrast, many traditional cosmetology colleges are expensive, drawn-out, and loan-driven. Those institutions often encourage multi-year enrollment to maximize federal aid, even if students’ economic prospects are limited. For example, the average cosmetology student debt is about $10,200 to enter a field where median wages are only around $26,000. Students leaving such programs must service loans that can take decades to repay. LBA’s license-focused strategy flips this: it aims for “immediate employment”, with fast-track programs and flexible scheduling so students “finish, pass their exams, and enter the workforce quickly”. In other words, LBA’s graduates emerge job-ready hairdressers, nail technicians, or aestheticians without the financial strings of debt, whereas traditional grads often start their careers still paying loans. LBA also frees students from the requirement of unpaid training hours; volunteers give service with recognition, but aren’t forced into exploitative labor. This student-centered approach yields a 95%+ graduation rate and reputational goodwill (alumni often launch salons or franchises), demonstrating that a license-based, cash-driven model can achieve better outcomes than the loan-dependent status quo.

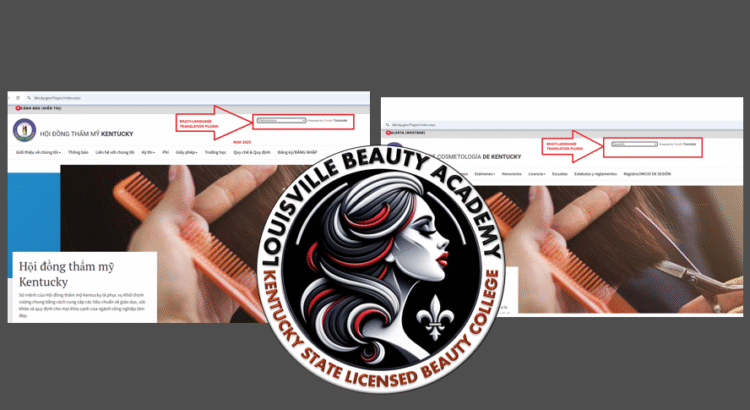

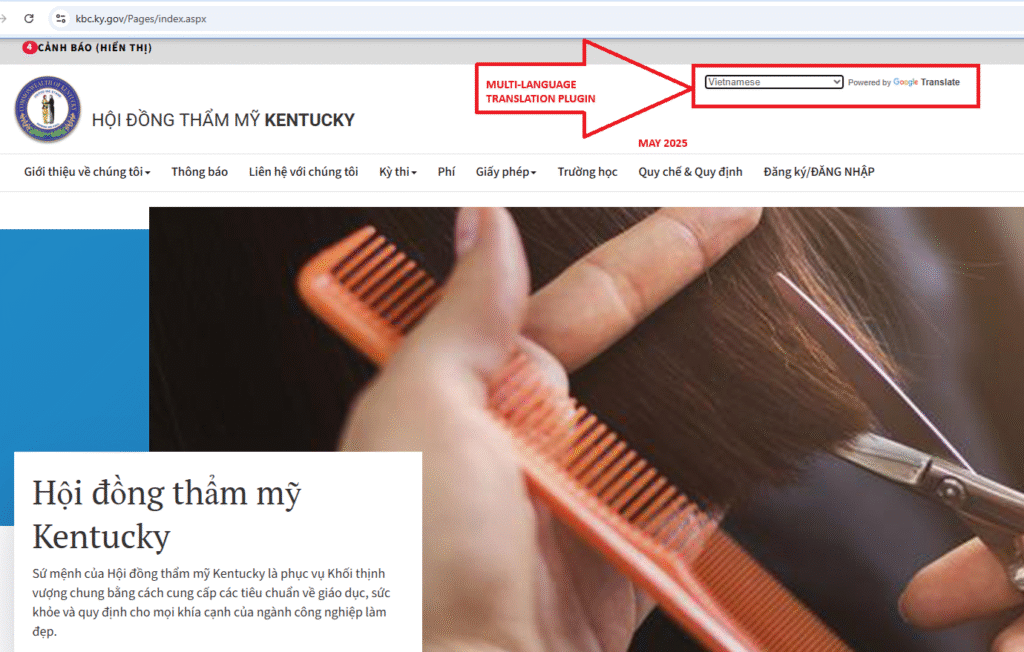

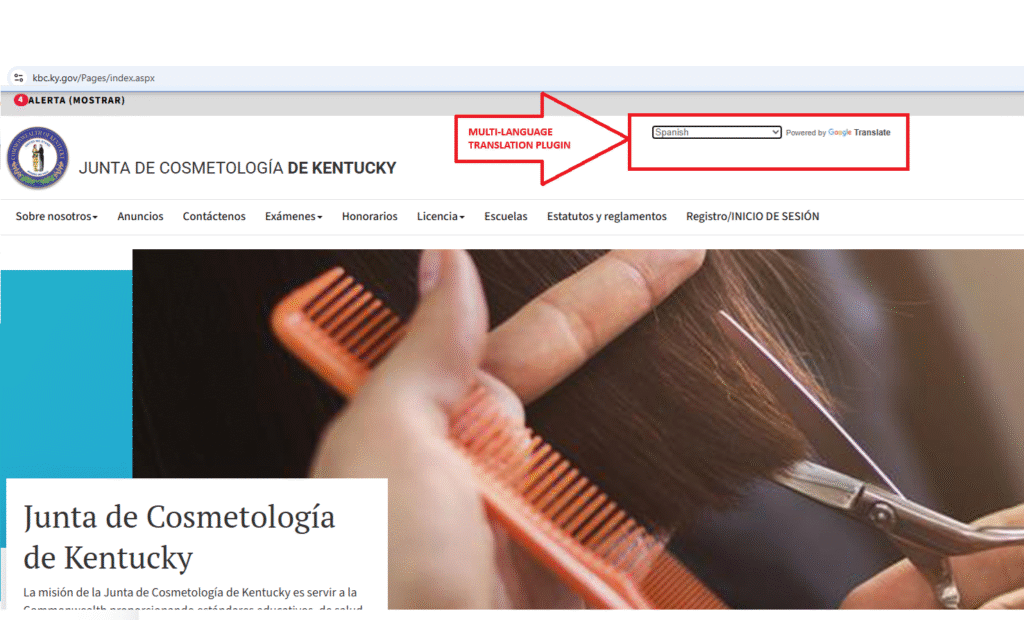

Scalability and Licensing Expansion

Importantly, LBA’s model is fully replicable and scalable. The academy has already laid groundwork for national expansion through a licensing/franchise program. In a 5-year licensing package, entrepreneurs and investors can open an LBA affiliate anywhere, using the proven curriculum, brand, and operational systems. Unlike rigid franchise chains, LBA licensing promises “more freedom & support” with lower fees (only a $30,000 total licensing fee). The beauty education market is large and growing: globally valued at about $9.17 billion in 2025, it’s projected to exceed $13.34 billion by 2033 (≈4.8% CAGR). North America alone represents roughly one-third of that market, driven by steady demand for certified professionals. Regulatory trends (new gainful-employment rules) are pressuring traditional schools to reform or fail. In this landscape, LBA offers a “force of transformation” with proven results: over 8 years it has graduated nearly 2,000 students and built a multi-million-dollar, multi-campus model. Its lean, AI-assisted operations and core focus on licensing mean each campus can be cash-flow positive quickly, with flexible tuition models and optional career support funding for students. For investors, that translates to strong ROI potential: tapping into a large, growing market with a unique value proposition (lower costs and high quality) and multiple revenue streams (tuition, licensing fees, retail products, continuing education). The social-impact angle also attracts grants and sponsorships, amplifying the financial viability.

Economic and Social ROI: A Win-Win Model

Investing in LBA-style schools yields compound returns. Economically, they create jobs (each graduate fills high-demand salon positions) and stimulate local spending. Financially, graduates are not burdened by debt, so they contribute more robustly to the economy through consumption and business creation. Socially, communities benefit from the academy’s philanthropic services – from reduced senior isolation to boosted confidence among the homeless or disabled. Each free haircut or manicure generates intangible value: countless studies document that grooming care boosts self-esteem and mental health for individuals facing hardship. When a homeless person receives a makeover, it can mean the difference between employment or continued destitution. LBA’s commitment (e.g. donating 30% of income to social programs) exemplifies “careflow” and “spiritflow” that reverberate beyond balance sheets. Importantly for policymakers, this model tackles multiple public goals: workforce development, poverty alleviation, healthcare savings, and education reform, all with minimal tax dollars. For instance, if expanded, programs like “Beauty for Connection” could save millions in Medicaid by preventing depression and falls among seniors. These multiplier effects enhance the return on any public or private investment in LBA’s model.

Call to Action: Support and Replication Nationwide

Louisville Beauty Academy has demonstrated a proof-of-concept: a sustainable, high-impact alternative to today’s beauty school paradigm. It unlocks higher access (through lower cost), ensures quality (through state licensing), and delivers enormous social value. The time is ripe for investors and policymakers to champion this “Freedom Factory” approach. Possible next steps include: encouraging states to allow similar non-federal-aid models for vocational programs; integrating LBA-like institutes into workforce initiatives; and providing seed funding or tax incentives for franchising this model across all U.S. counties. By supporting LBA’s expansion, stakeholders can catalyze an education revolution – one that creates wealth for entrepreneurs, opportunity for students, and wellbeing for communities. The results speak for themselves: LBA’s graduates are debt-free entrepreneurs, its neighborhoods are stronger, and lives are being transformed. As the founder emphasizes, “When people feel beautiful, they feel capable. When people feel capable, they believe in themselves. When people believe in themselves, they transform their lives.” It’s time to scale this vision. Investors and policymakers alike are urged to replicate the LBA model nationwide, unleashing freedom, flow, and uplift through beauty education.

Sources: Authoritative industry reports and LBA documentation were used throughout. For example, the Personal Care Products Council and Bureau of Labor Statistics confirm the beauty sector’s economic scale. Recent analyses document the high cost and low outcomes of conventional cosmetology programs. Case studies (e.g. Marinello) illustrate the risks of loan-based models. LBA’s own data and independent research (from NABA/IJ) provide insight into its programs and social impact. Together, these sources underscore why Louisville Beauty Academy’s debt-free, license-driven approach is both innovative and urgently needed. The evidence is clear: this model merits support, replication, and investment nationwide.

CITATION

Bond, H. (2025, May 13). Invest in the future: The Goddard School’s visionary franchise model. Franchising.com. Retrieved from https://www.franchising.com/sponsored/20250513_invest_in_the_future_the_goddard_schools_visionary_franchise_model.html

Butrymowicz, S., & Kolodner, M. (2024, May 9). For-profit beauty school settles class-action lawsuit. The Hechinger Report. Retrieved from https://hechingerreport.org/for-profit-beauty-school-settles-class-action-lawsuit/

Center for American Progress. (2017, March 29). Getting what we pay for on quality assurance. Retrieved from https://www.americanprogress.org/article/getting-pay-quality-assurance/

Cooper, P. (2022, March 27). Is community college worth it? A comprehensive return on investment analysis. Foundation for Research on Equal Opportunity. Retrieved from https://freopp.org/whitepapers/is-community-college-worth-it-a-comprehensive-return-on-investment-analysis/

Fast, C., Granville, P., & Moultrie, T. (2022, July 14). Cosmetology training needs a make-over. The Century Foundation. Retrieved from https://tcf.org/content/report/cosmetology-training-needs-a-make-over/

Institute for Justice (Menjou, M., Bednarczuk, M., & Hunter, A.). (2021, July 12). Beauty school debt and drop-outs: How state cosmetology licensing fails aspiring beauty workers. Retrieved from https://ij.org/wp-content/uploads/2021/07/Beauty-School-Debt-and-Drop-Outs-July-12-WEB.pdf

Louisville Beauty Academy. (2025, April 9). Pioneering the future of debt-free, purpose-driven beauty education. Retrieved from https://louisvillebeautyacademy.net/louisville-beauty-academy-pioneering-the-future-of-debt-free-purpose-driven-beauty-education/

Los Angeles Times. (2016, February 5). Marinello Schools of Beauty abruptly shuts down after federal allegations. Retrieved from https://www.latimes.com/business/la-fi-marinello-closing-20160205-story.html

National Association of State Directors of Career Technical Education Consortium. (2010). Return on investment in career and technical education (pp. 1–2, 37–45). Retrieved from https://careertech.org/wp-content/uploads/sites/default/files/ROI_in_CTE_-_FINAL.pdf

Salvation Army, Orange County, CA. (2024, October 4). Shears of Hope: Transforming lives one haircut at a time. Retrieved from https://orangecounty.salvationarmy.org/orange_county_ca/news/shears-of-hope-transforming-lives-one-haircut-at-a-time/

Tobin, S. (2024, October). Examining the outcomes of zero-fee education in building a resilient, inclusive economy in rural Alberta. Future Skills Centre. Retrieved from https://fsc-ccf.ca/projects/zerofee-edu/

U.S. Department of Education. (2025, April 21). U.S. Department of Education to begin federal student loan collections, other actions to help borrowers get back into repayment [Press release]. Retrieved from https://www.ed.gov/about/news/press-release/us-department-education-begin-federal-student-loan-collections-other-actions-help-borrowers-get-back-repayment